There is a lot to unpack in this statement ‘When’ not ‘If’.

My initial thoughts on the value of it is you want time passing to strengthen your investment thesis not raise more question marks.

You want to minimise stress and accept that it’s going to take time, probably more than you’d like.

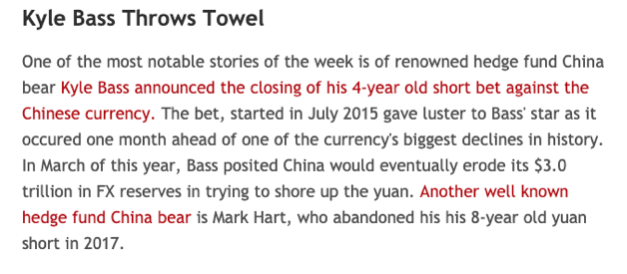

Just take one of my heroes Mark Hart; China Capitulation: Corriente Advisors’ Mark Hart Ends 7-Year Bet On A “Massive Yuan Devaluation”

“Mark Hart spent seven years and $240 million waiting on a crash in China’s currency. He lost sleep. He lost clients. He damn near lost his sanity.

And now he’s lost his conviction: Hart, who called for a more than 50 percent yuan devaluation last year, has turned bullish on China and its currency.”

I think the problem for both Hart and Bass was they were unable to go back to boring long term investing after nailing both the subprime mortgage bust and the European debt crisis.

They both became “long tail junkies”.

Source: http://www.ashraflaidi.com/forex-news/risk-can-t-stay-on-bass-gives-up

They had to hunt out the next big win even if there wasn’t one.

What are some lessons to be learned from them?

To start with they were all investing in ‘if’ not ‘when’ questions. When it comes to economies and governments nothing is ever certain.

You only have to look at the ‘widowmaker trade’ (shorting Japanese Government Bonds.) It sounded like an airtight case until negative interest rates came along and the BOJ started buying the majority of their JGB ’s to understand how crazy things can get.

‘When’ not ‘if’ idea is from Rick Rule who has some refreshingly simple views on some of his investments.

Uranium for example:

“If you have a circumstance where you know uranium is part of the energy future, and you know the industry loses money on every pound of uranium it produces, the question you have to ask yourself is: Will the price of uranium go up — or will the lights go out?” -Rick Rule

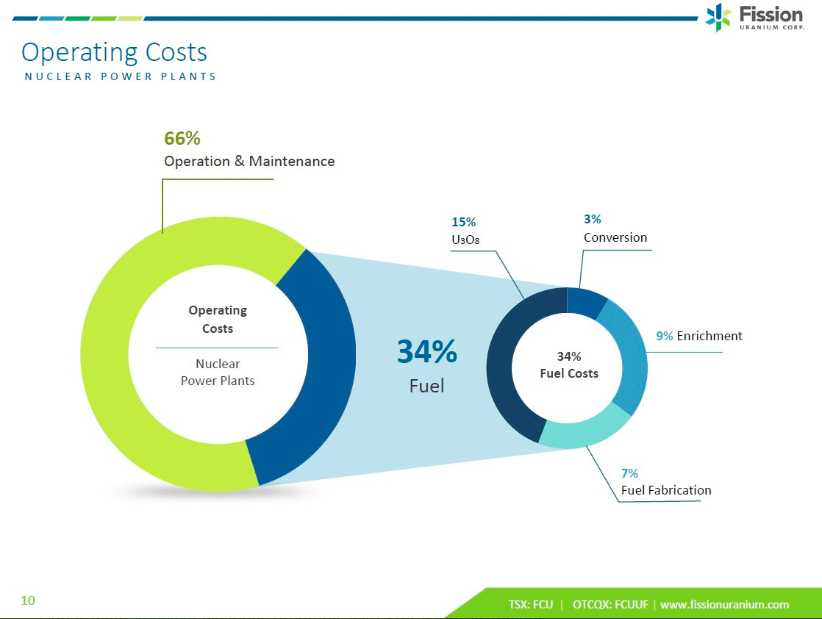

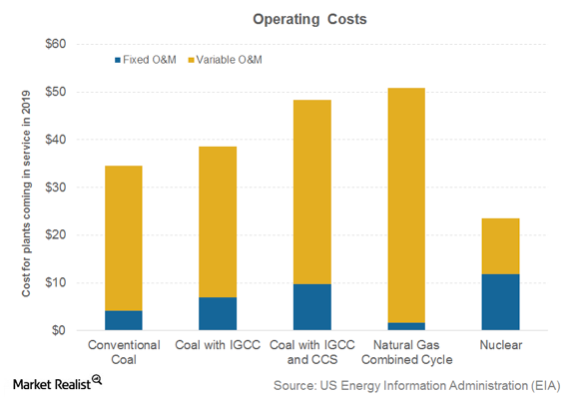

As nuclear makes my 20% of US with hundreds of billions invested in reactors so the idea they might not operate these reactors based on fuel cost which is approximately 15% of operating costs is crazy. For nuclear, the price paid to resupply is not nearly as important as just getting the supply. Reactors don’t shut down because the price of fuel is too high.

This argument is even more compelling when you understand the proportion that coal or gas make up of the operating costs of their respective power plants.

This all comes on the back of the fact we are requiring more and more energy each year: Energy growth isn’t slowing if anything its gaining momentum.

“It came as a shock for many when the International Energy Agency (IEA) released its 2018 world energy consumption figures a few weeks ago, showing a large unexpected increase of 2.3%. This marked the biggest increase in 10 years and eclipsed the 1.4% average increase over the last five years.”

Where is all this leading?

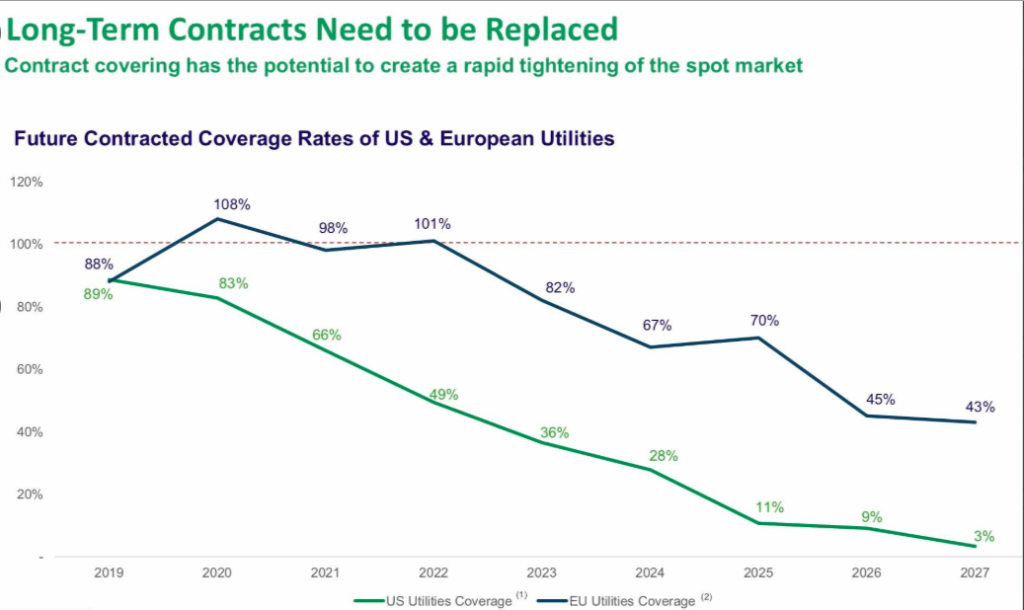

Now, I’m not silly enough to think I have any ability to forecast or predict prices, but one piece of information from Mike Alkin gives me enough confidence to draw a line in the sand for the Uranium recovery.

“About 80% of utility requirements for 2025 are uncovered.”

This roughly falls in line with the below graph and when you consider the US has 98 nuclear reactors (>30% global reactors) this is a big deal.

“

Further to this utilities must contract 18-24months prior too requiring the fuel, so that it can be enriched and processed.

Yes, it’s possible a few of them could get by on the spot market purchasing yellowcake or purchasing further up the fuel supply chain but this is only a short term fix

- Cameco which shut down McArthur River mine (which accounted for 13% of world production) is now buying its requirements 21-23mlbs in the spot market which generally has had an annual volume of roughly 50million lbs.

- The second point is that the 50million is largely based on Kazatomprom selling into the spot market (was a regulation of theirs to prevent corruption when signing long term contracts.) This has ended with them starting a Swiss marketing arm and selling large amounts directly to storage vehicles such as Yellow Cake which plan to hold the Uranium until prices are substantially higher. This suggests there is going to be a far tighter uranium spot market then many utilities have grown used to.

So to summarise;

- Uranium spot is likely to be very tight moving forward.

- Zero incentive for new supply to come on or mines be brought out of care and maintenance until uranium price rises north of $50lb.

- Price paid to resupply is not nearly as important as just getting the supply

- 80% of utility requirements for 2025 are uncovered

- Utilities must contract 18-24months prior

Ultimately, the utilities have no other choice but to start contracting—and soon—as their uncovered uranium needs exiting 2020 exceed 20%. From the order date, it takes utilities 18–24 months to get the fuel. For context, at the start of the prior bull market in 2003, uncovered needs were essentially zero for the following couple of years. – Mike Alkin

So a logical conclusion is price needs to exceed $50lb sooner than 2022 or the lights are going out on half of the US nuclear reactors!

Cheers,

Ferg