Everything that you’re about to read is just me trying to position myself to get lucky by finding the most asymmetric trades on this ball of dirt.

I’m not an economist or macro strategist throwing around theories with zero skin in the game.

I’m just a guy living in Bali who has scraped together some capital and needs to work out ways to grow it, or risks being forced to return to a corporate cubicle.

By seeing magazine covers (like the one below from Bloomberg) you know, there will be asymmetry in assets that will do well in an inflationary environment as its the last thing the market expects.

As it is, the complete opposite of what has worked well in the last decade.

Inflation? Isn’t everything going on currently deflationary?

Yes, it is.

“Secular inflation is almost always preceded by a downdraft of deflation” -Louis Vincent Gave

I’ve dug through dozens of arguments for deflation be it debt, demographics, deleveraging, or deficits.

While I understand their points there is one question that the answers fail to satisfy me.

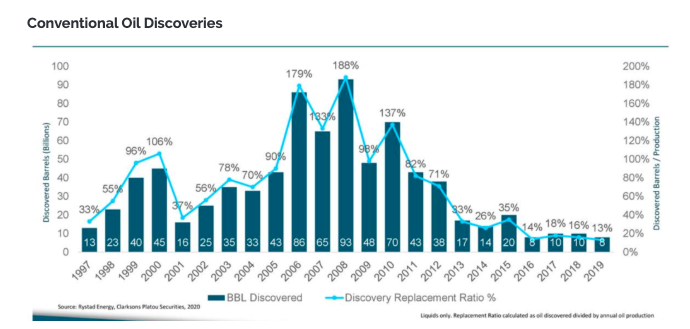

That is the question of energy

Low prices are the cure for low prices.

“It’s Armageddon for oilfield service companies,” said Andrew Graham a 20-year Schlumberger veteran cut in April. The biggest companies aren’t immune either; “Oil major BP plans to cut half its senior managers in coming months.”

Shell CEO Ben van Beurden insists he doesn’t run an oil company anymore. Then, in fact, he runs the third-largest company in the world by revenue (85% of which is derived from oil).

It speaks volumes as to where we are in the cycle when a CEO won’t even admit what business he’s in.

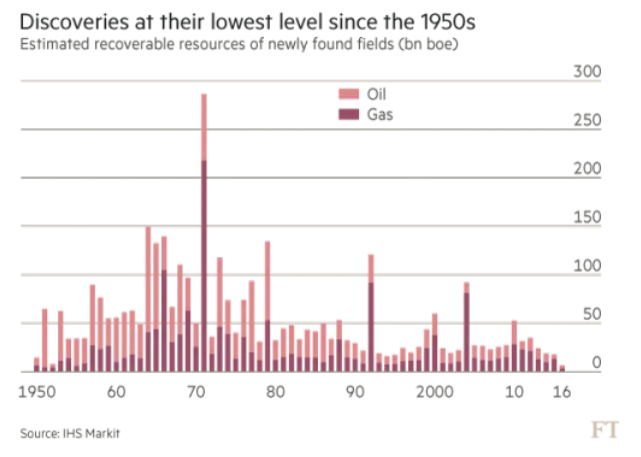

Now I don’t have the data for 2020 but I can only imagine that the discovery replacement ratio has been cut in half again with COVID and the oil price war (BP’s already slashed CAPEX by 25%)

When you look at the longer-term chart you can see that discoveries have been on the decline since the 1970s.

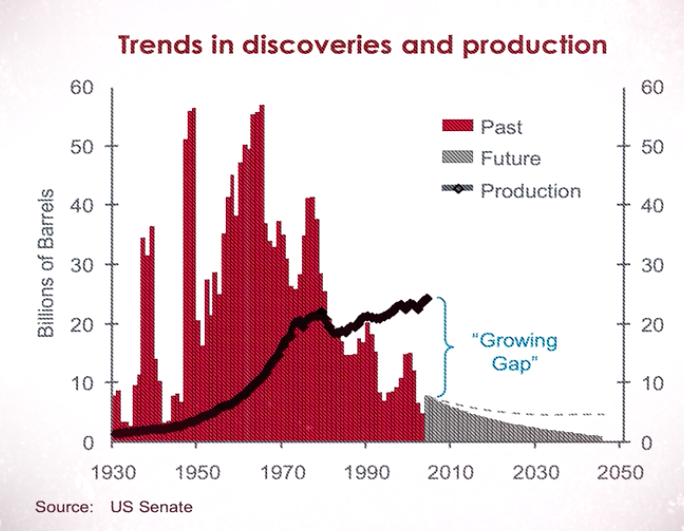

If I had to explain it all in one chart this would be my go-to as it illustrates the point well that we’ve had this gap widening for quite some time.

The main reason we haven’t had a supply crunch is because of shale’s extraordinary growth in the last ten years.

Consensus View

“Last time we did money printing nothing happened, so why worry?”

A major reason we didn’t get inflation was that globalisation was in full swing and in particular China’s effect on it.

China was doing massive infrastructure spending ($586 billion) post-global financial crisis.

Global supply chains held prices down as China turned itself into the world’s manufacturing hub with cheap labor.

That toaster that was made in US/Japan for $15 was now being made in China for $5.

This was hugely deflationary globally.

Tech also held prices down and was highly deflationary (just think TVs you now get twice as much for a quarter of the price).

Things have changed

I highly recommend you listen to everything Pippa Malmgren puts out as she has the most complete world view I’ve come across.

“This crisis marks the end of globalisation” – Pippa Malmgren

We’ve already seen it deteriorating with the trade war and now finger-pointing over responsibility for the virus (Trump blaming China).

We now have supply chains that are broken at both ends. We have a supply shock and a demand shock.

QE isn’t helping this time around

Pippa also goes on to explain why QE is ineffective in the current scenario.

QE assumes banks will on-lend the money- which largely can’t happen, as most peoples’ credit criteria are stuffed after being without income and missing payments and the demand for loans just isn’t there regardless.

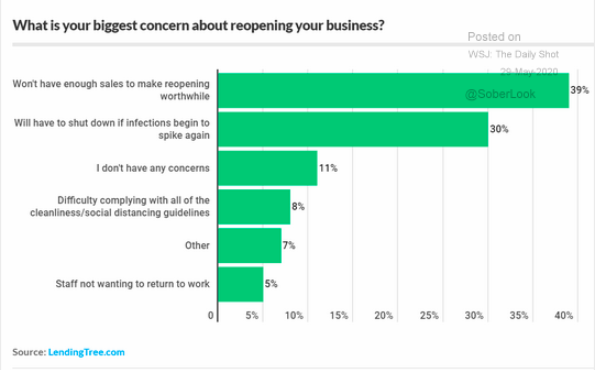

Also, even if people could get the money they have no feeling of the timing (would you really want to re-hire all your staff only for things to get closed down again?)

Take the example of a butcher that had to fire their small staff and close the shop for months, are they really going to rehire their 3 staff members and buy $50k of new meat when everything could be shut down in a week?

As no one knows when this will end, we could have rolling lockdowns (China and Singapore have).

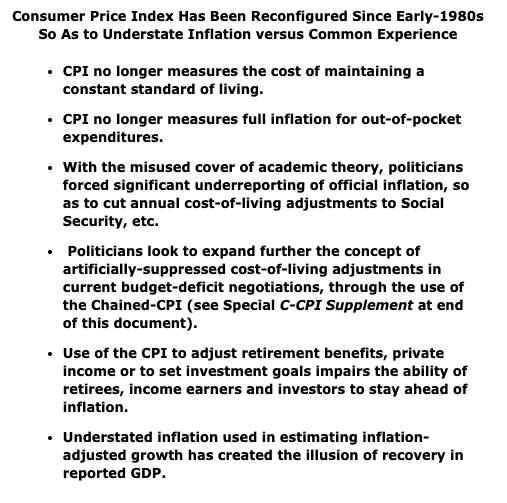

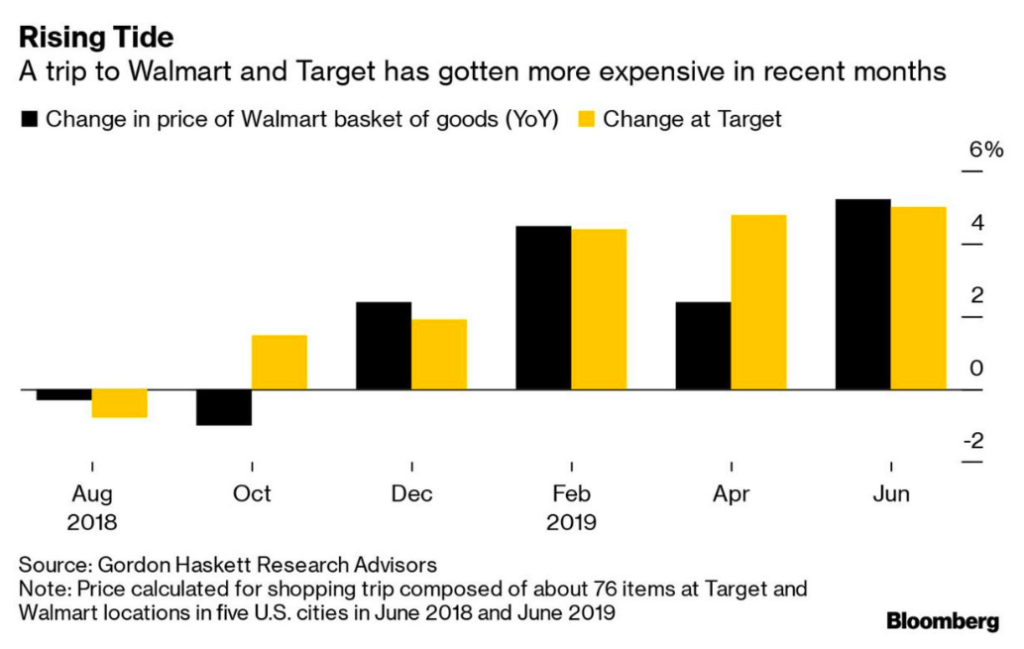

Inflation has already been rising

“The belief system is inflation is dead” -Pippa Malmgren

When really it has just been suppressed and hidden via adjustments to CPI .

Also via practices such as shrinkflation (below).

The below chart always astounds me, as 76 items in Walmart and Target are increasing 5% year on year yet CPI doesn’t budge.

This is all very interesting, but what’s the trade?

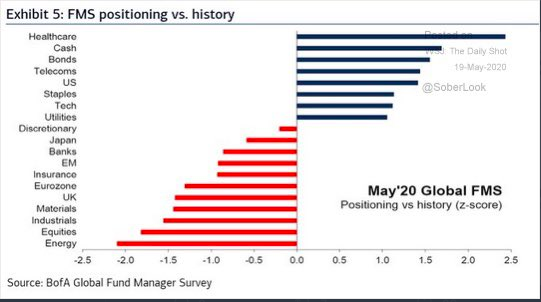

My mentor always taught me to hunt out the most hated sector in the market that stands to benefit from your view, as that is where the real asymmetry hides.

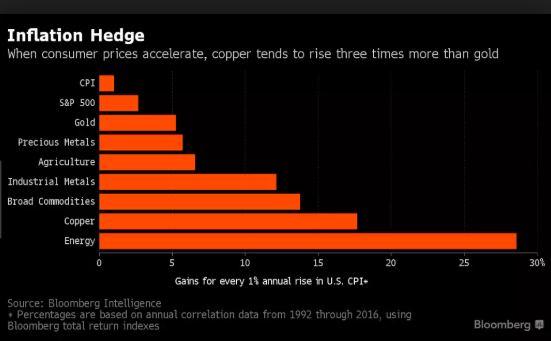

So what is the most asymmetric way to benefit from inflation?

Historically its been energy.

The subsector I’ve chosen to explore is offshore drillers as they fits this description well having dragged a number of contrarians along for a ride looking to end in chapter 11 for the majority.

A current example being Diamond Offshore Drilling.

Diamond Offshore Files for Bankruptcy Amid Historic Crude Crash

Diamond drilling has entered chapter 11 and is almost certainly going to wipe out current equity holders, according to its filings.

“The Company expects that its equity holders could experience a significant or complete loss on their investment, depending on the outcome of the Chapter 11 cases.”

Equity holders will get wiped out and secured/senior debt holders becoming the new equity holders (they maybe give 2% to the original equity holders as they did with $TDW and $SDRL).

The shares will be relisted and they’ll probably raise the rest then carry on as if nothing happened.

Chapter 11 Benefits

If you are around to pick up the relisted companies then there is some serious asymmetry to be had with a de-risked balance sheet and the increased efficiency of operations.

It goes without saying that I’m only looking at highly cyclical companies that aim to benefit from rising commodity prices (I won’t be lining up to buy JC Penny anytime soon if it relists).

As the whole process leading up to bankruptcy is like someone surviving hard times they get leaner, meaner, and more efficient.

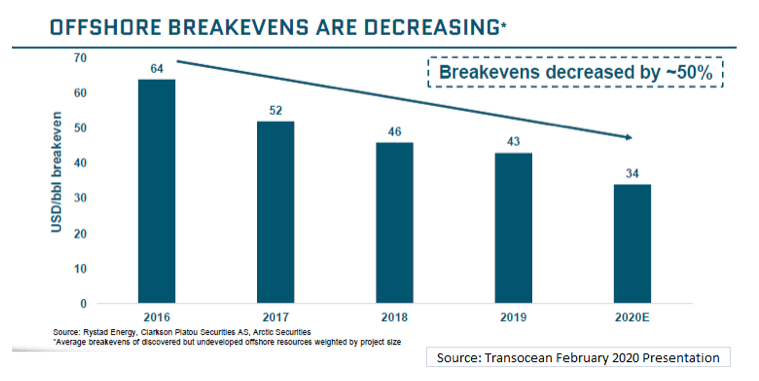

Just take offshore drillers struggling to survive the past years.

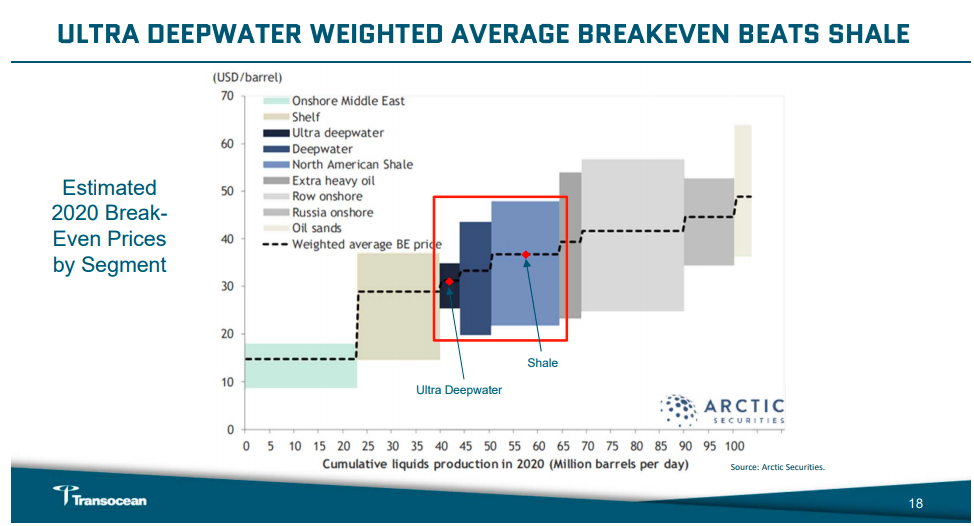

As few would realise, these tough years and resulting efficiency gains have dropped offshore breakevens below shale.

The previous shareholders have done all the heavy lifting and you get to come in and enjoy the good times.

It reminds me of this as you often need bankruptcy in a sector so prices can be reset to make things economic moving forward.

“The companies that laid fiber optic cables which cost $2,000 a mile all went bankrupt, but the tech paved the way for internet companies such as YouTube and Facebook” -Josh Wolfe

Then there is the potential for sweeteners such as warrants.

You can even be incentivized to purchase shares upon re-listing as tidewater did by throwing in some warrants.

“As previously disclosed, the Series A Warrants and Series B Warrants were issued to holders of Tidewater’s pre-emergence common stock upon the Company’s emergence from chapter 11 reorganization in accordance with the Company’s Second Amended Joint Prepackaged Chapter 11 Plan of Reorganization.”

If diamond drilling re-lists with an offer for warrants I’ll be all over it like a fat kid on a cupcake.

As the thing with Diamond was it was a tactical bankruptcy.

“The Debtors determined to commence these Chapter 11 Cases to preserve their valuable contract backlog, and preserve their approximately $434.9 million in unrestricted cash on hand while avoiding annual interest expense of approximately $140.1 million under the Revolving Credit Facility and the Senior Notes, and to stabilize operations while proactively restructuring their balance sheet to successfully compete in the changing global energy markets. The Debtors and their Advisors believe cash on hand provides adequate funding at the outset of these cases.” -link

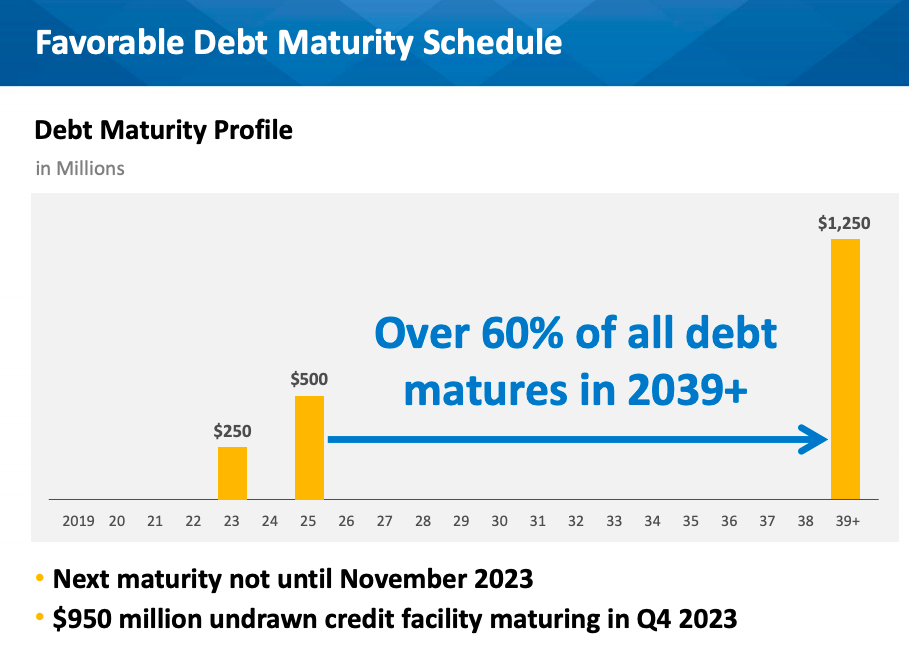

They didn’t have much debt maturing and hadn’t drawn down their revolver loan facility.

The only immediate debt maturing soon is $250m in Nov 2023 which I’ll be interested to see where it stands, following them re-emerging from chapter 11.

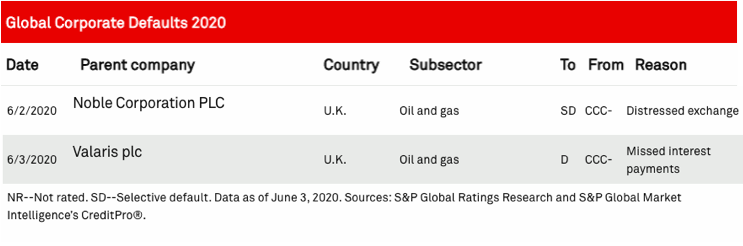

Valaris is likely to enter Chapter 11 in the next month or two following defaulting on interest payments this month. Noble doesn’t look to be far behind either. I see it as inevitable if they are to be competitive with the likes of a restructured Diamond drilling.

So the next big trade for my portfolio will be the stand out of these restructured offshore drillers or perhaps a basket of them. As few trades will match their upside potential combined with reduced risk profile having just emerged from chapter 11

Cheers,

Ferg