The coal sector’s popularity might seem at an all-time low yet history would suggest this is nothing new.

“For over a thousand years coal has been used as a source of energy and has been controversial for virtually that entire time. King Edward the 1st of England (the same Edward “Longshanks” who fought Mel Gibson in Braveheart) outlawed the burning of coal in 1306 under penalty of death due to the pollution it was causing in London. It is believed that he even had a person executed for burning coal and had a few others tortured.”

– Stephen Rosenthal

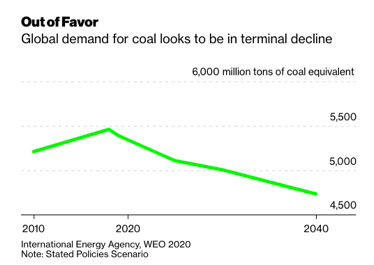

The comforting narrative is that the coal sector is in terminal decline and we will see it quickly replaced by renewables over the coming decade.

While the end of coal growth may be true in developed countries with the notable exception of Japan (that just approved 22 new coal plants) we often overlook the fact that developed countries are the minority globally.

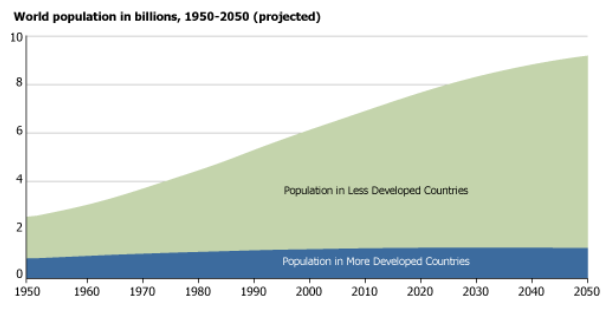

The developing world will add more people to the total population than the developed world over the next 20-30 years.

Put another way- by 2050 it’s probable that developed countries will represent less than 15% of the world population.

Yet, the terminal decline of coal makes us feel good so the narrative sticks.

Morgan Housel said it best:

“Tell people what they want to hear and you can be wrong indefinitely without penalty.“

The majority of banks and asset managers are cutting out coal quicker than steak in a vegan restaurant.

I now have a folder full of snips from articles pointing to coal’s imminent demise.

The thing is coal still accounts for 36.4% of global electricity production (bp Statistical Review of World Energy 2020)

Coal is still the most accessible and cheapest form of energy globally, apart from gas in some areas (if you object to this point and want to throw an LCOE chart at me please read this first).

The reality is we need an awful lot of additional energy moving forward to keep up with developing countries’ growth.

Roughly 2 billion extra people will be added to this world by 2050 before you consider currently just under a billion don’t have access to reliable electricity.

Before getting caught up in the narrative it pays to get ahold of the hard facts.

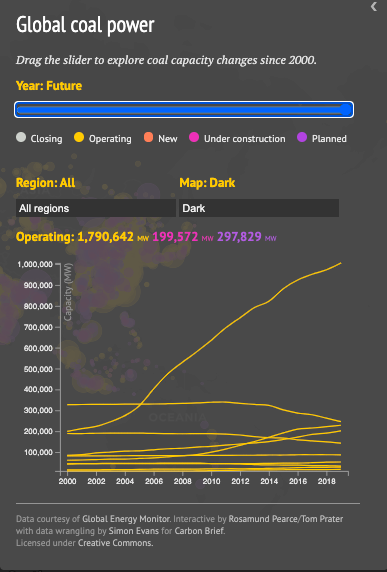

How many operating coal plants there are in the world?

How many are under construction?

How many are planned?

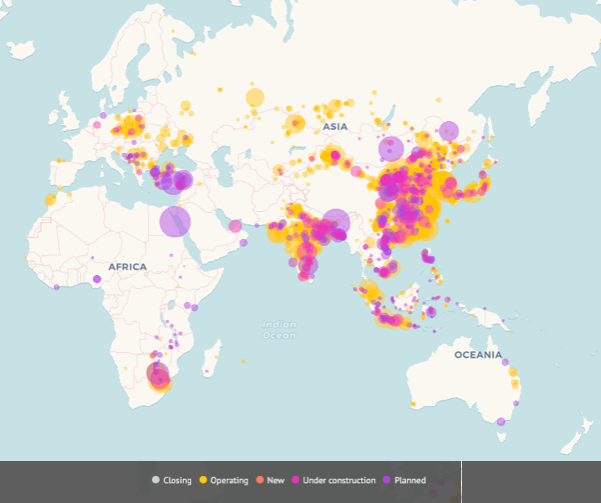

Carbonbrief does a wonderful job of outlining all of this.

There are 1,790,642 MW of operating coal plants globally down from a peak of 2,044,831 MW as a result of 268,000 MW of retirements across the EU and the US.

Another 213,000 MW is planned to retire over the next decade with climate targets being put in place to met Paris Agreements targets.

For this to happen we need to have the rapid build-out of renewables which I’m skeptical will occur, particularly in the developing world.

On the other side of the equation, we have 199,572 MW of new plants under construction returning the total coal plants to just under their peak.

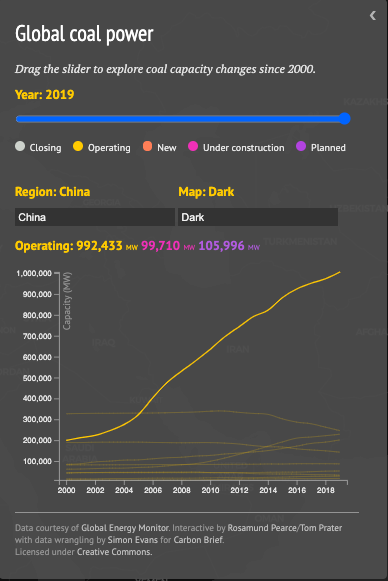

China, which represents over half of the operating coal fleet, is adding 10% to its coal fleet by 2025 and has a further 10% planned.

The above figures are conservative according to some reporting such as Reuters which pegs the number at 250GW of additional coal plants under development.

“It now has 97.8 GW of coal-fired power under construction, and another 151.8 GW at the planning stage.”

If we stick with the conservative numbers globally there is a total of 297,829 MW planned.

In short, there are plans to add nearly a third to the global coal fleet from today’s levels and if the 213,000 MW is retired early we still end up with a growth of 16% from today’s levels.

That doesn’t sound like terminal decline…

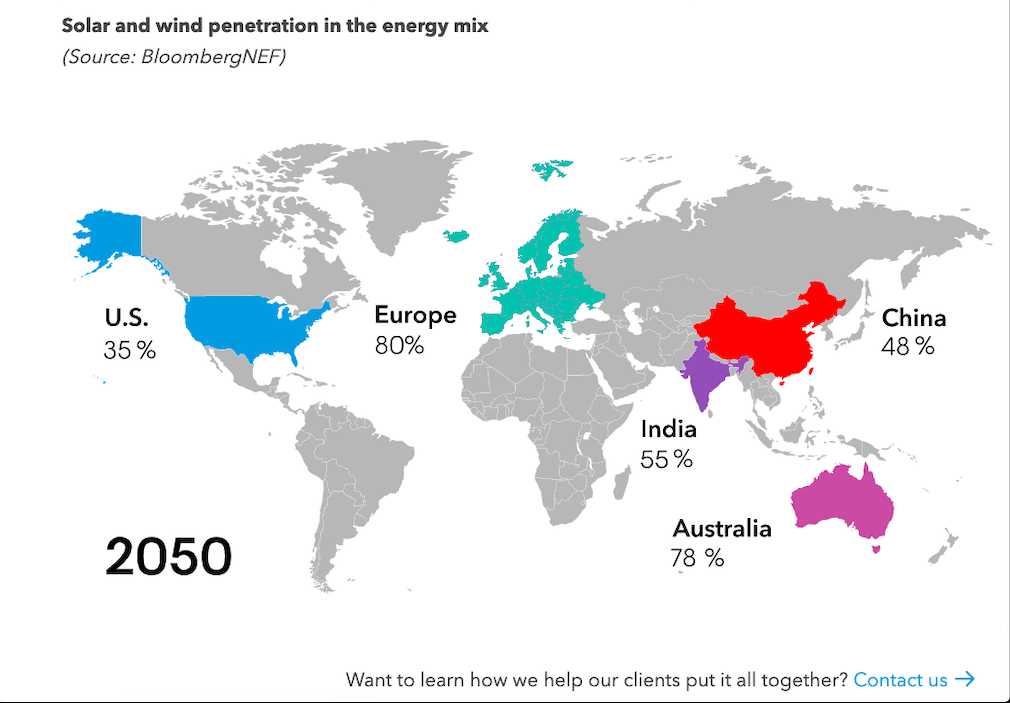

There is also the point I touched on in Renewable Debate that China, India, and South Asia simply aren’t that well suited to renewables. Both have low average wind speed (check out Global Wind Atlas) and solar is extremely tough to scale to the level BloombergNEF is projecting.

The issue with solar at scale is not only the obvious generation during daylight hours only, it’s the fact that winter months only produce half the generation of summer months (excluding equatorial regions). This means you need a tonne of excess capacity to cover the winter months which strains the economics.

It also pays to consider how the current leaders in this renewables trend are faring. Germany and California’s attempts to date are hardly instilling confidence.

Moral case

Whenever I mention coal on Twitter I invariably get some hate mail calling it immoral to discuss coal.

The way I see it is it’s immoral to cut developing countries off from coal power when there is no viable alternative that is economic and reliable.

It’s my biggest gripe with ESG is the idea that cutting off capital to areas of the energy sector will speed the energy transition. It’s as boneheaded as the defund the police movement in US which has had predictable results.

ESG should be pushing clean technology in the fossil fuel space. We now have High-Efficiency, Low-Emissions Coal Plants (HELE) which run at a far higher efficiency than standard coal plants with only CO2 released into the atmosphere.

Figures from the World Coal Association, a keen advocate of HELE show that the average efficiency of coal-fired power plants around the world today is 33 percent. Modern state-of-the-art plants can achieve rates of 45 percent, while “off-the-shelf” rates are around 40 percent. Increasing the efficiency of coal-fired power plants by just 1 percent reduces CO2 emissions by between 2–3 percent.

High-Efficiency, Low-Emissions Coal Plants: Come HELE or High Water

How about Supply?

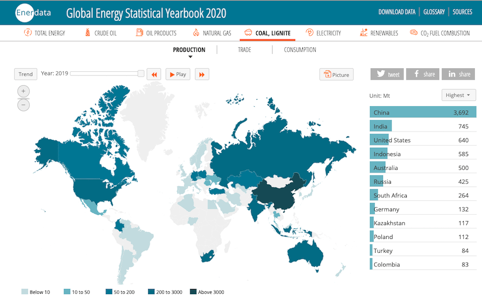

As you can see below China is nearly half of global coal production, with India, the US, Indonesia, Australia, and Russia sharing the remainder (Global Energy Statistical Yearbook).

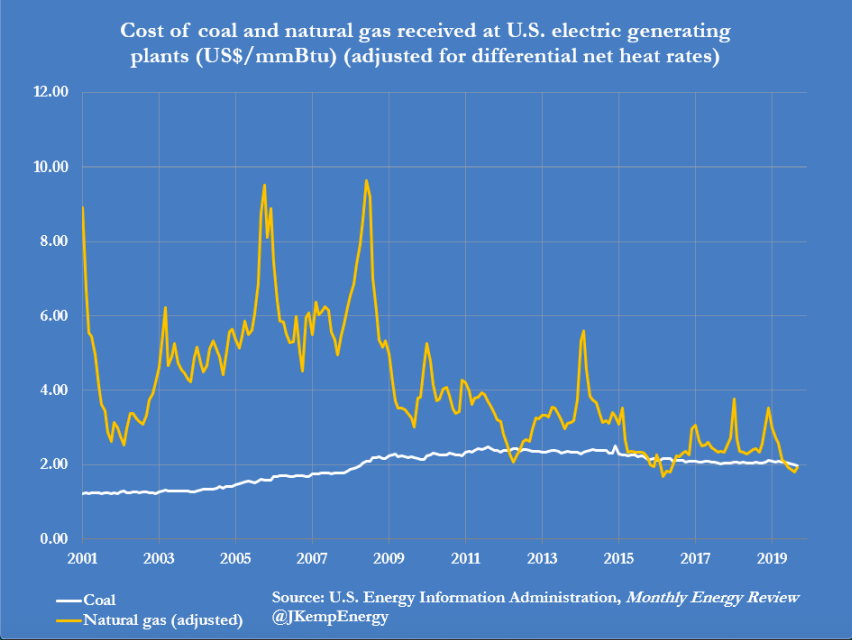

Cheap gas has been crushing coal in the US.

This has been largely a result of the natural gas glut as its largely been a by-product of oil in fracking.

Since shale production has continued to surprise to the downside we have seen natural gas prices jump.

“Natural gas’s share of generation is expected to fall to 33% from 39% this year.

While coal is expected to climb from 20% to 25% in 2021”

Thermal or Metallurgical coal?

I like both but the contrarian in me leans towards thermal coal for a few reasons.

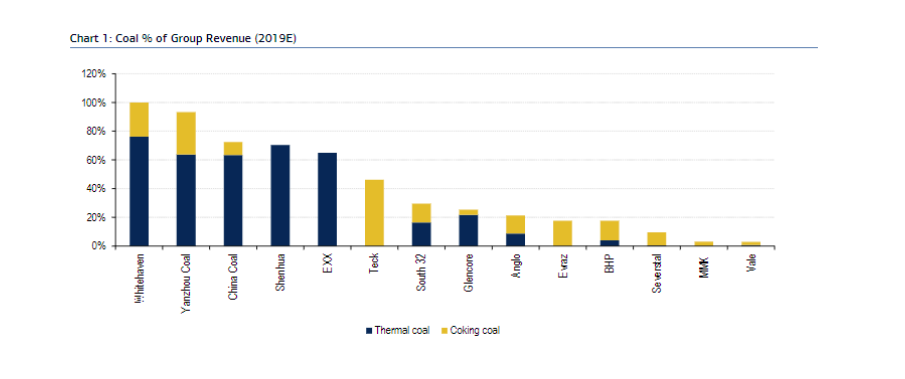

Met coal isn’t being ostracised the way thermal coal is.

Some big coal players may escape BlackRock’s planned divestment

BlackRock’s plan is to remove from both its actively managed equity and bond portfolios shares of all companies that generate more than 25% of their revenue from thermal coal production. BlackRock expects the cull to be completed by the middle of this year.

This means it’s really only thermal coal that is largely being cut off from the capital markets.

Where this gets interesting

Coal is essential to developing market energy growth yet the US and EU is doing everything it can to cut it off from capital.

Banks are increasingly pulling the plug on coal and finance is becoming harder to come by.

Take Peabody Energy in 2016 with a free cash flow of $527 million and net debt of only $593 million yet it could not re-finance debt due in 2022 and ended up declared bankruptcy.

Any institution with an ESG mandate can’t go near them regardless of the performance.

This results in high barriers to entry since no competitors can get financed or get acceptably priced capital from the markets.

Grant a permit for a new coal plant?

Forget it.

Even if you do get the permits you can easily get tied up in courts by a bunch of teenagers with public opinion behind them.

So, incumbents simply tighten their belts cut CAPEX, and pay down debt.

If coal prices continue to rise they will generate large free cash flow, yet institutions restricted by ESG mandates won’t jump in to bid them up.

Meaning they will end up paying big dividends and buying back shares.

A similar situation occurred with Tobacco stocks.

The industry was thought to be in trouble with huge lawsuits, regulation on top of regulation, and a public understanding of the health impacts of smoking.

What happened?

Huge outperformance across the whole sector and fat dividends along the way (if you reinvest the dividend the returns are truly astronomic).

How to play it?

The KOL ETF is no longer an option with it being delisted on Dec 22, 2020, which is a contrarian sign in itself.

My default is to buy a basket to help reduce the risk of getting caught out with a single stock risk.

I prefer those companies that have managed to extend their debt out at least another 3-4 years.

The good thing about my coal thesis is it will either prove correct and I’ll average into the positions over time or it will take off along with oil, gas, and uranium negating my thesis.

If I’m right, there is no rush in this sector as I believe the excess returns are going to accrue for years to come.

Currently, I have a heavy allocation to uranium, natural gas, oil (offshore driller and oil service stocks), and tankers.

Coal represents ~2% of my portfolio at the moment yet I can picture a point in the future where it could account for 20-30% of my portfolio if coal companies’ free cash flow continues to climb while their share prices lag.

What would be in this Basket?

Stanmore Coal Ltd (ASX: SMR)

Yancoal Australia Ltd (ASX: YAL)

New Hope Coal (ASX: NHC)

Whitehaven Coal Ltd (ASX: WHC)

Peabody Energy Corp (NYSE: BTU)

Natural Resource Partners L.P. (NYSE: NRP)

Why just Australian and US names?

Safety for one. I don’t feel the need to try my luck with Chinese and Indonesian coal companies (or if I do, I want them to be under Australian reporting standards i.e. Yancoal Australia).

The Australian coal companies have largely been financed by Asian banks and extended their debt maturities out to 2024 and beyond which removes the risk that Peabody experienced in 2016 and again late last year.

Lastly, the West is in the process of building moats around these companies as banks, pension funds, and institutions with ESG mandates cut them off from capital. Producing coal is highly capital intensive so good luck getting finance to expand and build new mines, let alone start a new coal company in developed countries.

Takeaway?

If this thesis is correct then coal should substantially lag uranium, natural gas, and oils performance. While the coal companies free cash flows will steadily grow.

If coal rallies right alongside the rest of the energy sector then the thesis is null and void.

Cheers,

Ferg

P.S Because resources in the coal sector are few and far between I thought I’d list the ones I’ve got a lot of value out of.

Lyall Taylors LT3000: Contrarianism; ESG investing; coal; and climate change (this is a masterpiece).

Kuppys Adventures in Capitalism: ESG = Excessive Share-price Growth

Kopernik Perspective: Is Coal Dead?

Argus-Petcoke Presentation on Sustainability

Lastly, if you are concerned with the moral aspect of investing in coal I highly recommend you read: The Moral Case for Fossil Fuels by Alex Epstein. As it lays out the other side of the argument which rarely sees the light of day.