The uranium market is like a spectator sport where you all sit in a stadium and watch a car go around the track and bet on when the car will run out of fuel.

It is not a debate if the car will run out of fuel its simply a matter of when.

The more laps (time) go by, the higher the odds.

Paying attention to details like the Kazakhs deciding to furlough its non-essential works and cut back wellhead development is like hearing the driver put his foot down.

You know fuel consumption has gone up, milage has gone down, and your odds just keep getting better.

COVID-19: Update on Kazatomprom Operations

“In April, we announced measures to protect our people by reducing the number of employees on sites to minimum possible levels, for a period of three months. Throughout that time, we have followed government restrictions and health advice, however, we believe that the pandemic-related risks still remain too high for a full return of production employees to our sites. We are therefore extending the period of reduced operational activity for an additional month, with the intention of gradually increasing mine site staff levels at the beginning of August, if it is deemed safe to do so.”

This is what has got them worried as the shut down was started in early April when there were a couple of dozen daily new cases. Now, here we are at the end of June with 1500 cases per day.

Will this rollover and things be back normal in a month’s time?

Maybe, but I won’t bet on it.

Why is this a big deal?

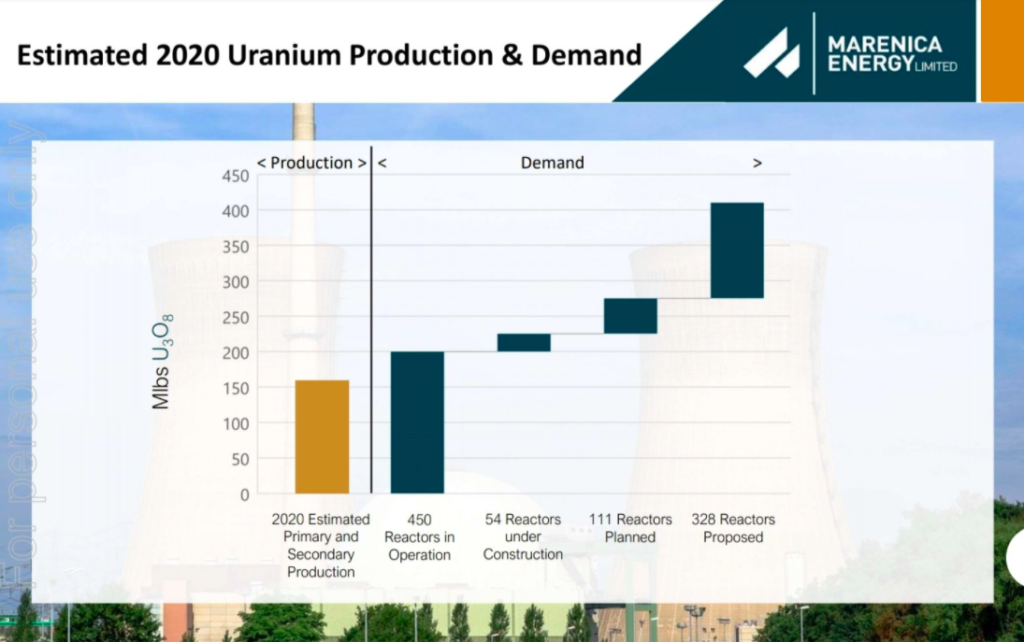

We now have the vast majority of global uranium production (baring Olympic dam) offline or operating at reduced capacity with Cameco, Orano, and possibly now Kazatomprom buying on spot.

I’m as excited now about this market as the crypto guys were at the top.

Even if all possible production comes online ASAP the outlook is still bullish.

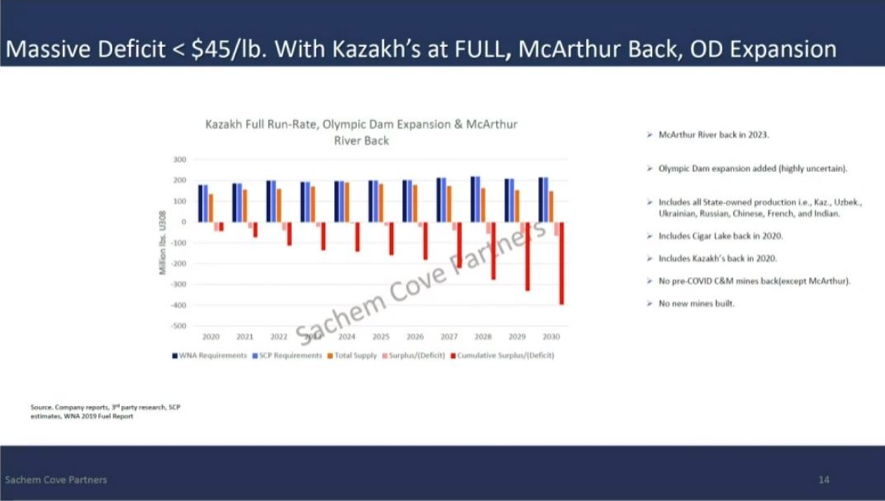

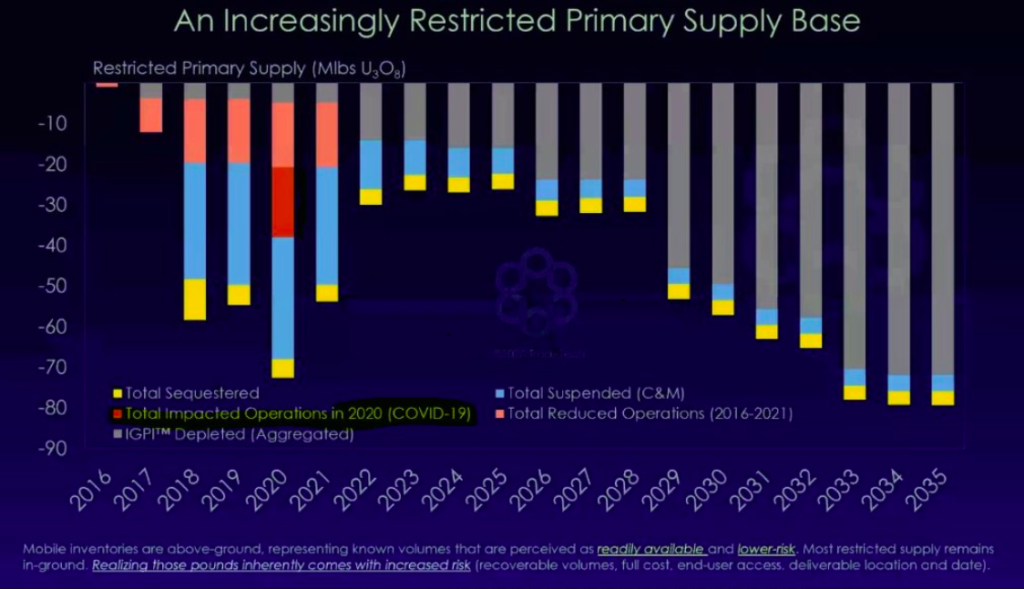

Mike Alkin presented the below chart at The International Uranium Digitial conference a few days ago.

This chart shows how the deficit still grows dramatically even if every possible production is ramped.

Even the improbable like Olympic Dam expansion.

Now, consider the last bull kicked off in 2005 with a surplus of 72mlbs five years out and never went into deficit even during the flooding of Cigar.

Take the above chart with all the production ramped and you are still looking at a deficit of ~150mlbs five years out or 3x worst situation than the 2005 outlook.

But, how much inventories do utilities hold and when will they be forced to start buying?

I like this chart, but I have no idea how accurate it is.

Now, I’m not smart enough to work out if this is accurate but I can shamelessly coat-tail the few I know of in the whole nuclear industry that have done the work required to know the answer to this.

Those are Mike Alkin and Tim Chilleri who have painstakingly modeled out each and every reactor’s requirements, every mine’s production capability, and so on.

We were lucky enough to have this gem of a recent interview with Mike and Andrew Weekly from Smithweekly.

Here are my notes:

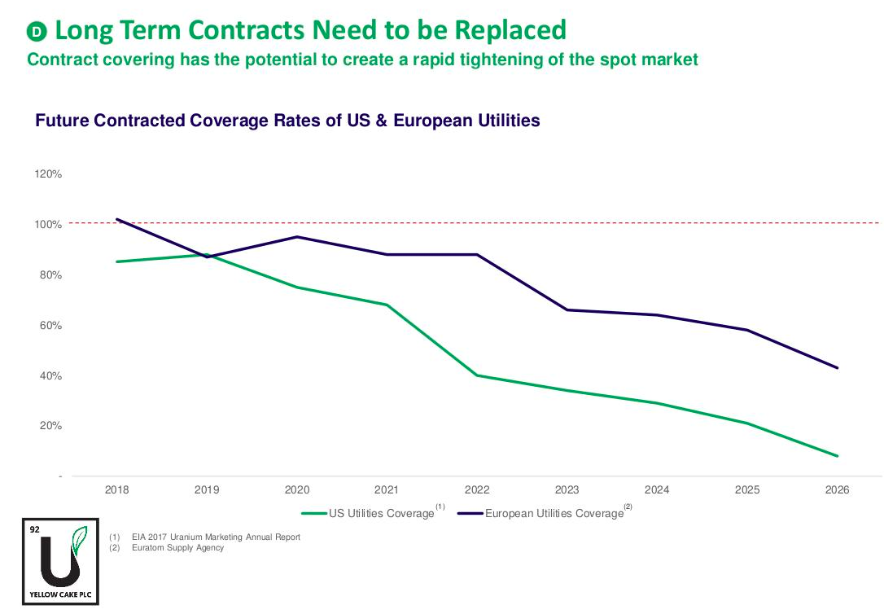

AW: Where do you see utility coverage?

MA: We think they (the utilities) have rolled off far more than people think they have. Our proprietary work is that uncovered demand is much higher than the market thinks it is.

AW: Do you think current conditions could last to 2022?

MA: No, we would think it is way sooner than 2022. 3month, 6months, 9 months who knows.

AW: More on utilities contracting requirements?

MA: They (utilities) will contract more than their immediate needs

On future needs:

“The world needs two to three more Kazatomproms by 2030” – Riaz Rizvi

What’s my takeaway from all this?

That the people who have done the numbers are saying this bull is going to start rolling in the coming months and the fundamental drivers (lack of supply) are magnitudes bigger than the last uranium bull market.

I love how some of the smartest investors I follow are trying to make the bear case work.

Be it Mike Alkin with the chart from his International Uranium Conference I showed earlier or Uranium Insider’s Justin Huhn who put this brilliant piece together which is a must-read.

I also love the complexity of this market and all its moving pieces and at the same time its simplicity. ~450 nuclear reactors need uranium of which there is no substitute.

No other commodity has such inflexible demand.

As we continue to see, the supply destruction is just getting silly now with the addition of COVID’s effects.

Ideas on how to play it

Only a tiny fraction of the hundreds of uranium companies from the last boom actually managed to develop their mines and get into production.

This combined with the supply destruction of skilled workers in the sector (listen to 1:14m mark) makes mines in care and maintenance the best balance of risk vs reward in my opinion (sure some explorers/developers will produce bigger returns but they are hard to pick and riskier).

It’s hard to f#ck up a simple restart.

The two, in particular, I’m fond of is Paladin Energy and Boss Resources.

I’m not going to do a deep dive of either of these now (maybe another time). The point I find interesting was that even the bear cases required all mines in care and maintenance to be restarted and still didn’t balance supply with demand.

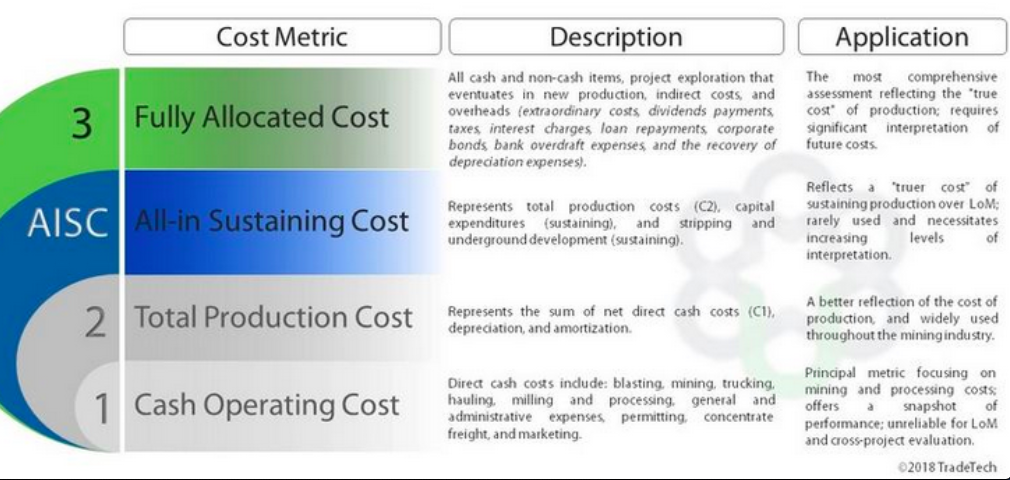

If Paladin restarted, it will mean they have sold term contracts at a decent margin (they have C&M costs and 2023 maturity to consider) to their $33 ASIC (All-in sustaining cost). So, I’m pretty damn sure it won’t be trading at 12c anymore.

If you were to hold a gun to my hand, I’d say north of 50c.

I can’t see Boss Resources lagging this by much either.

Which isn’t really a terrible bear case scenario.

Cheers,

Fergus

P.S. Pays to understand this chart well as I see way too many people talking AISC not realising how much higher fully allocated costs actually are (let alone if they are talking cash cost).