I’ll give The Economist some credit for at least bothering to turn it into a question this time around since their last call didn’t work out so well.

Where does oil demand currently stand?

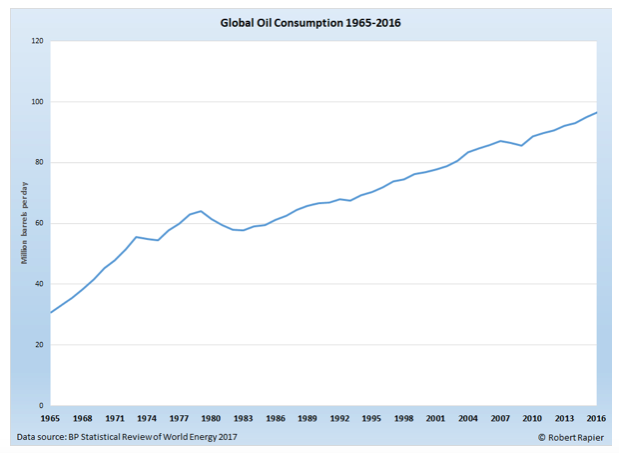

In round numbers, world consumption was 100 million barrels per day (pre-COVID).

Currently, it’s around 93 million barrels per day of which:

– India consumes 5.2 million barrels a day

– China consumes 14 million barrels a day

– U.S. consumes 19.4 million barrels a day

Yes, people were literally locked in their homes for months, the economy was ground to a halt, air travel was ceased, and demand only dropped 7%.

Oil demand is one of the most robust trends in the world, bet against it at your peril.

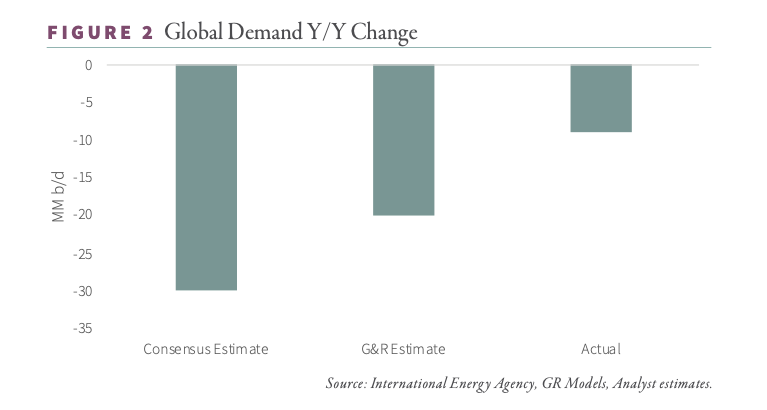

Goehring & Rozencwajg make this point well with the chart below.

“Not only was the decline much less than expected, but the recovery has been much faster as well. Core petroleum demand in the US has now regained 70% of its total peak-to-trough decline in less than five months. Preliminary Chinese customs data suggests that second-quarter petroleum demand was up 10% year-on-year – the strongest reading ever. “

-Goehring & Rozencwajg

Another way to illustrate this point is by looking at the global financial crisis, or the 1973-74 oil embargo’s impact on oil demand.

Rob West nailed this point with the below breakdown.

“We have this two-tiered energy market.

We have the developed world with 1.3 billion people who consume 60% of all the world’s stuff.

We have the developing world, which is almost 6.5 billion people who consume the other 40%.

Just to put that in perspective relative to the oil market, in oil, the developed world, there are 13 barrels per person per year.

In the developing world, it’s three barrels per person per year.

As those three barrels go to four barrels by 2050, not to the 13, we have in the developed world, but just from three to four, and as populations in the emerging world go from 6.5 billion to 8.5 billion, we’re going to end up in a world where there’s 60,000 terawatt hour energy system becomes 120,000 terawatt hour energy system. “

Put simply, based on developing country’s population growth the energy system is going to double by 2050.

We are going to have a tough time keeping up with that demand before taking into account ESG, shale, and renewables shortcomings.

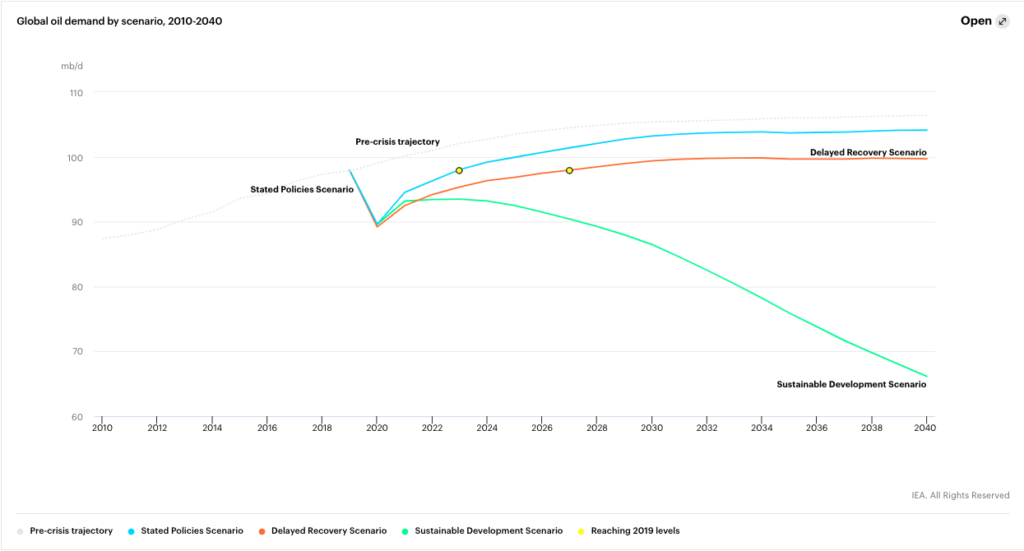

I hope you now grasp the magnitude of how utterly batshit crazy it is to consider anything other than the pre-crisis trajectory.

Supply?

Here is the recent view of oil supply from this The Economist article.

“First, fears about fossil-fuel scarcity have given way to an acknowledgment of their abundance.

Not least because of what has been achieved in America, the energy industry now knows that it will be lack of demand, not lack of supply, which will cause production of oil, coal and, later, gas to dwindle.“

This has it precisely backward.

Or to turn it into an analogy:

Lady Astor: “You, sir, are drunk.”

Winston Churchill: “Yes, madam, I am. And you are ugly. But tomorrow I will be sober.”

Oil demand is drunk, while supply is ugly.

Oil supply has turned ugly because of a mix of five factors

- Big oil slashing CAPEX/insufficient discoveries

- Shale Implosion

- Renewable/EV projections

- ESG

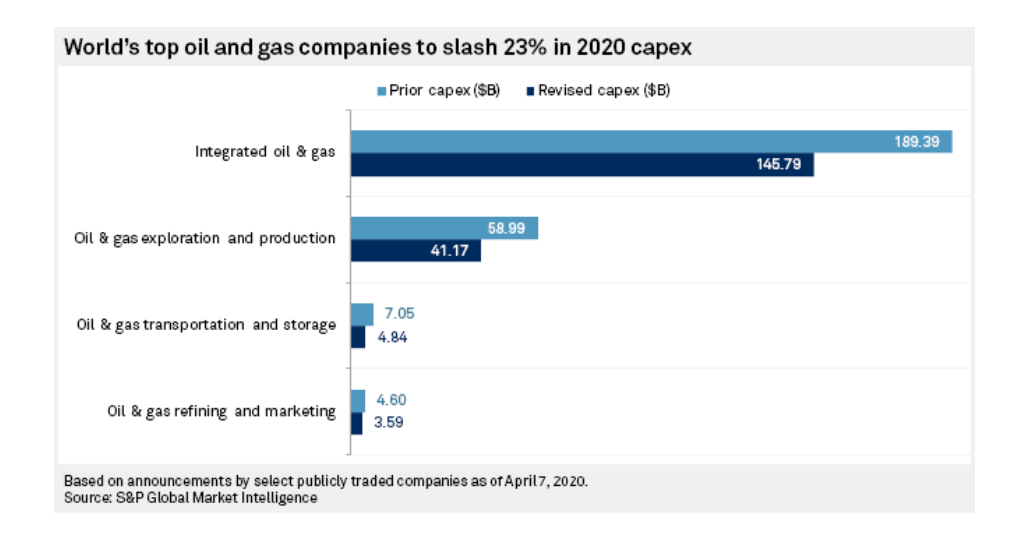

Big oil slashing CAPEX

I’ve gone over this in the next big trade post with oil discoveries and replacement rate being at multi-decade lows.

Remember the earlier point of the energy system doubling by 2050 on the back of developing countries population growth?

Well, due to decline rates if no new oil is found, then supply will sit around 20 million barrels per day by 2050.

So, rather than double we are looking at 80% less.

Big oil has slashed a further 23% off already tight CAPEX this year. The Russians are expecting CAPEX to tumble 31% this year, according to Evercore ISI.

Shale Imploding

The consensus seems to be that this will bounce back just like it did in the 2016-2018 period with articles like this: Reports of Shale’s Death Were Greatly Exaggerated.

I don’t believe there is a snowball’s chance in hell of this.

Goehring & Rozencwajg tells us a 2017-2018 rebound is not possible because the inventory of high-quality drilling prospects has been exhausted via high grading ( I highly recommend you read their piece on it).

They further broke it down here in their latest commentary

What the market does not appreciate, however, is how sharply production is about to fall from here. After having completed 850 wells monthly between February and April, the shale industry completed only 280 wells

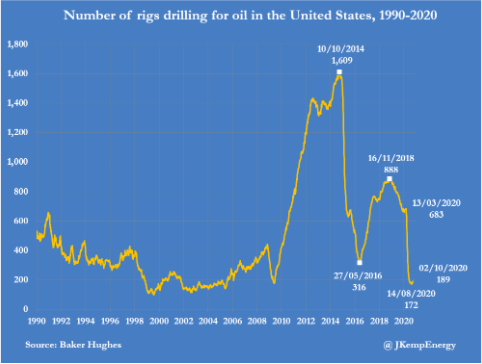

per month in May and June – a reduction of nearly 70%.There are only 10 rigs currently drilling in the Bakken shale compared with 50 at the start of 2020 and 200 in 2014. In the Eagle Ford, the rig count has gone from 70 earlier this year to 11 today. Even in the Permian, the rig count has fallen from over 400 to less than 120 today. Since these slow downs work with a two-month lag, they will only begin to impact production in the July and August figures.

Our neural network tells us that US production will fall by as much as 2 mm b/d during the second half of 2020 and by as much as 1.5 mm b/d in 2021 unless much higher prices encourage a substantial drilling rebound (something we do not believe will happen). The IEA expects US production to rebound from the June lows by 500,000 b/d by the end of year. This is simply not possible.

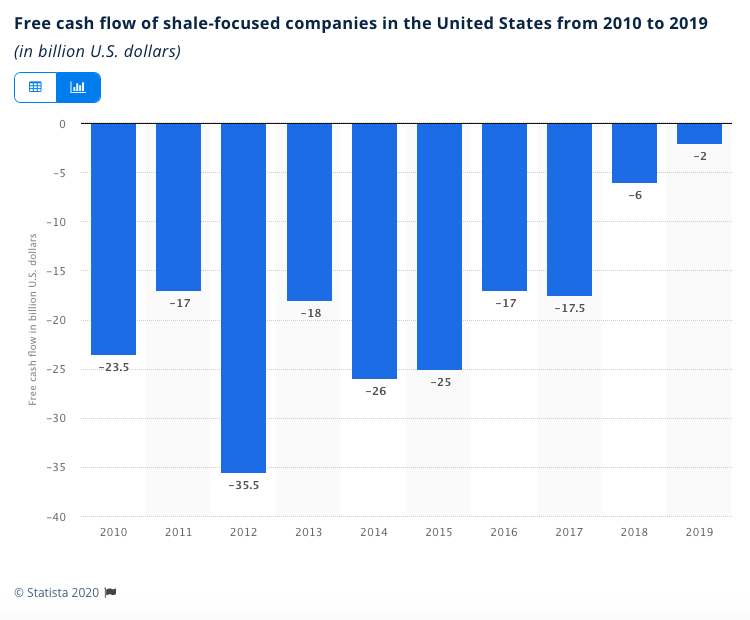

Thinking Shale will continue to have easy access to capital is also foolish since they’ve already burned bankers and private equity.

The only ones that have made any money out of shale to date are the CEOs/management.

You only have to look at their free cash flow during the 2010-2014 period with oil around $100barrel.

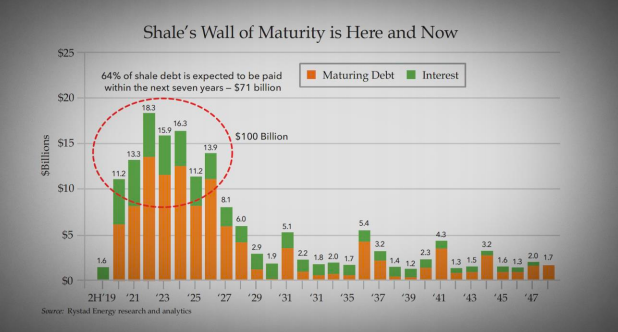

ESG is going to further starve them of capital making it very difficult to roll their debt. Especially with weekly announcements of banks and institutions submitting to ESG pressure and dumping fossil fuels

Just look at the below maturity chart. You know they are up shit creek without a paddle.

Sure there will be a percentage of shale that will be economic bounces back and bounces back strongly, but it will be a shadow of its former self.

Renewable/EV projections

I’m not going to dive into renewables again as I laid out my thoughts here in Renewable Debate, but I will touch on one point that annoys me.

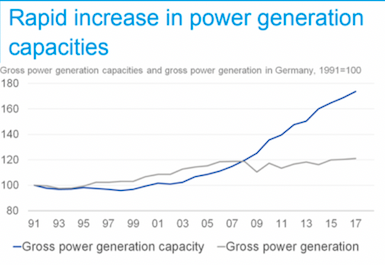

Power generation CAPACITY isn’t bloody power generation!

A 100MW wind farm is really only 20-40MW depending on the capacity factor.

Take nuclear at 90% capacity factor, that 100MW is 90MW of generation or functionally three to four “100MW wind farms” and you still need back up…

Once you realise this, combined with the doubling of our energy system by 2050, you quickly conclude we need a stupid amount of renewables to maintain generation while retiring fossil fuels, let alone double it.

Germanies efforts to date in the chart below illustrate this problem perfectly.

A lot of effort and cost to get nowhere on the generation and emission front.

ESG

Starving an industry of capital that is essential to humanity’s progress is never a bright idea.

Take any other essential area and it’s easy to see how illogical this is:

Starve certain schools of capital to improve the overall level of education?

The logical way would be to increase funding with strict new regulations/ targets.

ESG is simply a product of an easy money environment. It hasn’t added any value and likely never will.

If you want to read someone light years smarter than I break this down then read this.

Or, if you want me to break it down for you in a cartoon…

The irony is rather than support the transition to renewables this will help set the stage for one epic energy bull market.

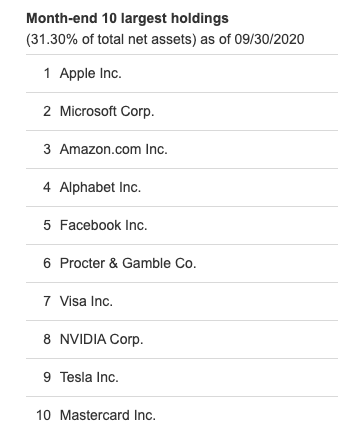

In which ESG will be all but forgotten as to date its performance has largely been a result of tech outperformance.

Take a look at Vanguards Social Index Funds top 10 holdings:

I wouldn’t touch these social funds with the shitty end of a stick as they are simply FAMGA in drag.

It is interesting to see which oil majors are holding their ground and which are changing pronoun declaring themselves no longer oil companies.

“In an interview, Shell CEO Ben van Beurden insists he doesn’t run an oil company any more.”

It isn’t just PR this time either, with them putting their money where their mouth is.

Take BP as an example:

“It marks a small setback for BP’s hopes to sell $25 billion in assets by 2025 in an effort to reduce debt as it begins a shift towards low-carbon energy.

BP said it had already completed, or agreed, transactions approaching half of this target, including a $5.6 billion sale of its Alaska business and a $5 billion sale of its petrochemical business.“

This makes BP largely uninvestable in my view.

Holding fire sales for their oil assets while buying into renewable projects at a premium is the definition of sell low, buy high.

Larger Implications = Inflation

Now, macro forecasts are largely a mug’s game and we don’t need inflation to make money in energy so I considered leaving this topic alone.

But I couldn’t help myself following hearing two people (Lyn Alden & Kevin Muir) I greatly respect and who are light years smarter than me reach similar conclusions.

Highly recommend you watch Lyn Alden here and Kevin Muir here or here.

In short:

- Monetary policy (QE) was ineffective as it got caught up in the banks reserves and not lent out into the economy.

- The world has woken up to fiscal policy which is a different beast as it gets around the above issue and is now palatable i.e bailing out small business instead of big banks.

- Political incentives: Fiscal is going to continue gaining traction and grow in size. Take quantitative easing 1,2,3 and 4.

- There is efficient and inefficient fiscal. Efficient is building factories, roads etc post WII. Inefficient is paying people to stay home and not work.

- Globalisation was deflationary and has now been put into reverse.

- MMT believes deficits don’t matter and inflation can be controlled (I agree with the first point and disagree with the second).

- There may be no financial constraints on a currency-issuing sovereign, but there are real resource constraints.

Or to put it simply:

Supply destruction of things essential to human progress

+

Large fiscal spending and demand recovering from COVID shock

=

Cost-push inflation (the bad kind i.e stagflation)

Energy is the most important of the real resource constraints as it is completely intertwined with our economies.

Take the below example:

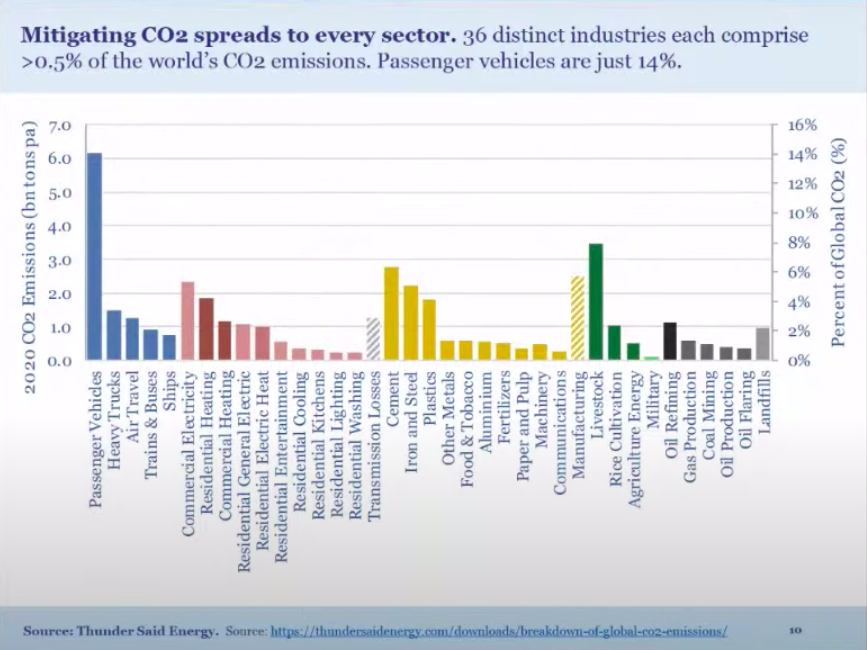

“Energy is used in ways that can just be so hard to see as a consumer. We think about driving passenger cars as a big source of emissions, it’s 14%. It’s the biggest source but it’s only 14% and actually, if I was going to add up all of the components of the energy system that are more than 1% of global emissions, I would have 35 different things on that list.

It would include things like cement, which is 8% of emissions or agriculture, which is about 13 or making metals, which is about 10%, or making things like ammonia in order to make fertilizers. If we end up without enough energy, actually, it’s in the stuff that we’re going to see problems. We’re going to see big inflation in the prices of stuff that really matters to the seven and a half billion people in the world.” -Rob West

I don’t believe it’s a coincidence that these magazine covers are popping up around the same time.

Thoughts on how to play this?

I think you could do a lot worse than simply buying the vanguard energy index fund VDE and reinvesting the healthy dividends (6.77%).

In the same vein, Lukoil and Gazprom make a lot of sense with their near 10% dividends and focus on running their businesses efficiently instead of destroying their business in the name of ESG or climate change.

Hell, you double your money in seven and a half years simply reinvesting the dividend if the share price stayed static.

I view these options as the new bonds. You have great yields, the potential for solid capital appreciation, and inflation protection.

That said, these names are not where I’m positioning myself.

Heading further out the risk curve

I’m further out the risk curve because I’m young and need to be. I’m generally not in a trade unless I see a 5x return as a reasonable possibility.

Offshore Drillers

I am still waiting for the offshore drillers to relist as I wrote about here.

I do want to reiterate that I don’t own any of them currently, I plan to build positions in those in the best shape following relisting. This will be alongside senior debt holders who have now become equity holders during the restructuring.

These new equity holders aren’t under any illusions of how the sector has been performing, so will want a large runway for the company to get back on its feet. This will be particularly true if they relist soon into pretty dire sentiment.

Before I move on, the question I get most often regarding offshore drillers is should I buy Transocean?

The answer is no. It is a lose-lose situation in my view.

If it avoids chapter 11 it will be at a large disadvantage ($9B of debt) compared to those that did restructure and cleaned up the majority of their debt.

While if it enters chapter 11 it’s highly likely you’ll be wiped out as an equity holder.

Oil Service stocks

This sector has been brutalized. Most names I’ve followed continue to grind lower and show zero signs of life.

The current position I’m putting stink bids in for a euro is Saipem (SPM.MI).

It’s one of the largest oil service stocks in the world. It has 32,000 employees a market cap of 1.45B, cash of 1.53B, and debt of 3.2B.

Major shareholders are: The oil giant Eni S.P.A represents 30.5%, CDP Industria S.p.A is 12.5% (which is 80% owned by the Italian Government) and Capital Research and Management Company owns 5% (they are privately held and have 9% of British American Tobacco so obviously aren’t too worried about ESG).

Sure, they took a hit in 2020 as did every oil company but when you read through their 2020 presentation it’s positive with a €24B backlog of oil, gas and renewable projects.

Yes, the share price looks grim but this is when I like to force myself to put low buy orders in for quality names I think will make it through to better times.

I’ve learned my best investments always felt awful when I bought them.

Too early? Probably but it will always look obvious after the fact.

If I can hold my discipline and steadily put 1-3% into positions like this, (then do my best to forget I own them) I should be pleasantly surprised with the results in a few years.

“Most of the gains in life come from suffering in the short term, so you can get paid in the long term” -Naval Ravikant

Cheers,

Ferg