I enjoy researching obscure little sectors that supply is unable to keep up with demand moving forward.

That said, this isn’t really anything groundbreaking with the majority of the commodity sector in that boat.

So, what makes the Rare Earth (RE) story particularly attractive to me:

- It’s the most attractive risk-reward in the battery metals space

- It’s the least susceptible to substitution

- Geopolitical implications with China monopolising production and processing

- Is a hedge if renewable/EV reality does live up to projections.

- My preferred positions include uranium resources.

These reasons, which I will expand on below, have earned it an allocation in my portfolio.

Demand story

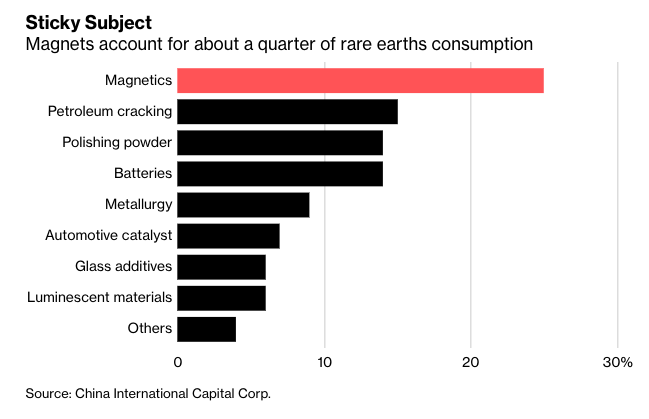

REs have a number of applications that are looking to grow steadily over the coming years.

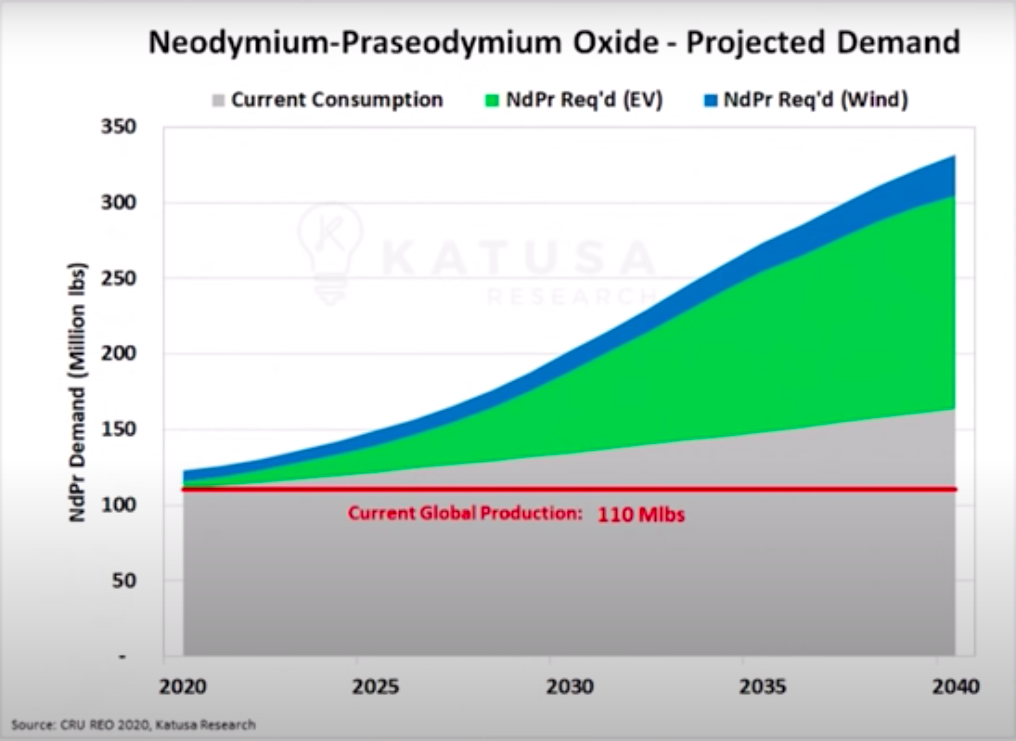

The aspect that is really looking to move the needle is neodymium magnet also known as permanent magnets.

The demand story is an easy pitch with NdFeB magnets replacing induction drive units in electric vehicles (they provide the torque) and replacing gearboxes in wind turbines (currently onshore only due to weight issues).

REs unlikely to fall victim to substitution

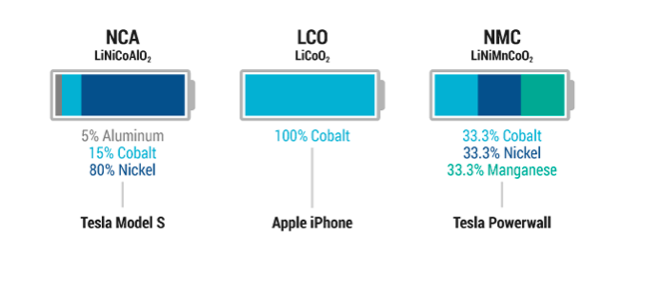

I’m generally bullish on most of the battery metals, yet struggled to figure out which horse to back. Unlike the uranium thesis, substitution is a major factor that I found out the hard way with cobalt (Tesla Targets Cobalt-Free Batteries in All Models or New cobalt-free lithium-ion battery reduces costs without sacrificing performance ).

So, while I still hold small copper, nickel, and cobalt companies, RE companies are heavier weighing in my portfolio.

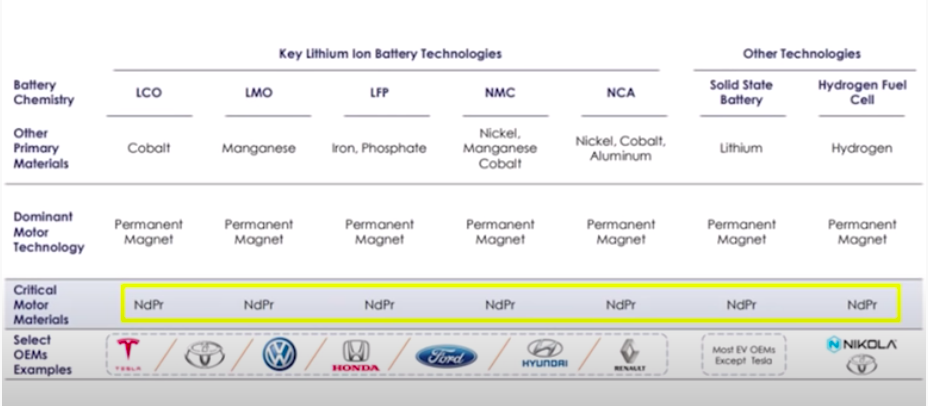

The debate is still out to which battery is going to reign supreme with various battery chemistry being utilised by different manufacturers.

Here are a few examples:

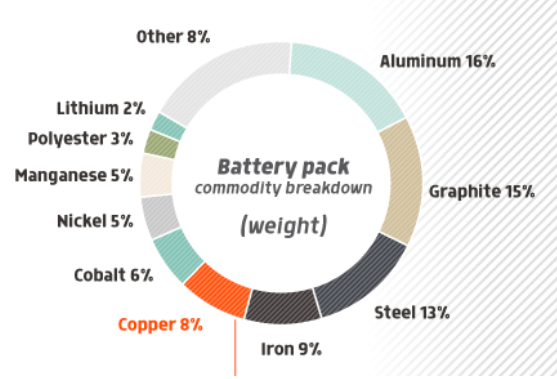

Or, take the Chevy Bolts current battery pack.

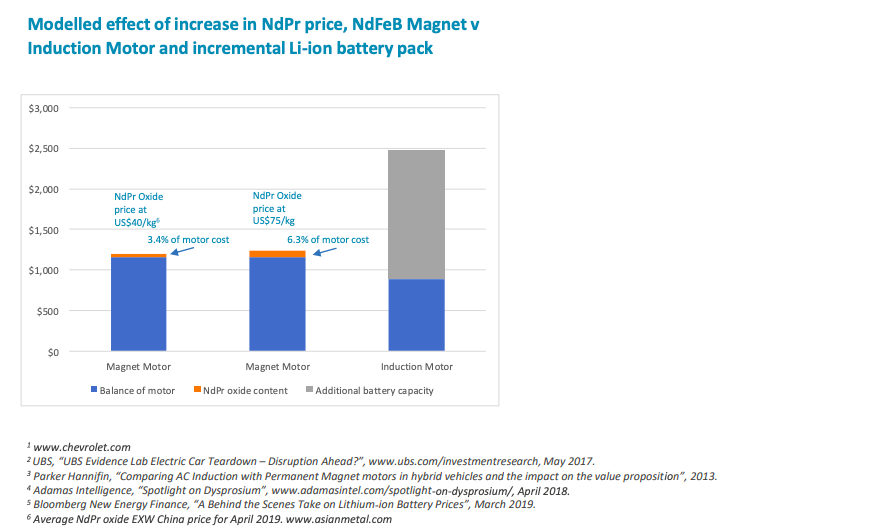

While question marks still remain as to which battery technology will come out on top, there is one constant that is outlined in the chart below.

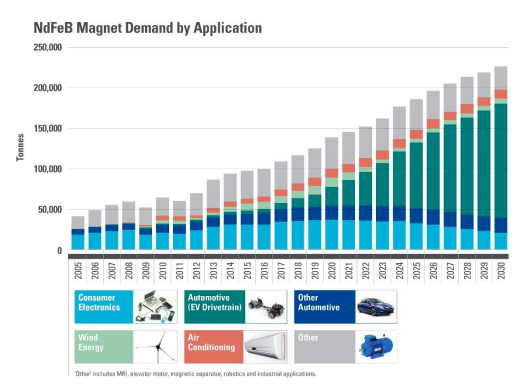

Permanent magnets have unanimously won out over induction drive units.

The reality is now that each and every electric vehicle is going to require approximately a kilogram of NdFeB.

While a direct drive wind turbine, which is projected to account for 30% of new onshore turbines, requires approximately 200kgs of NdFeB.

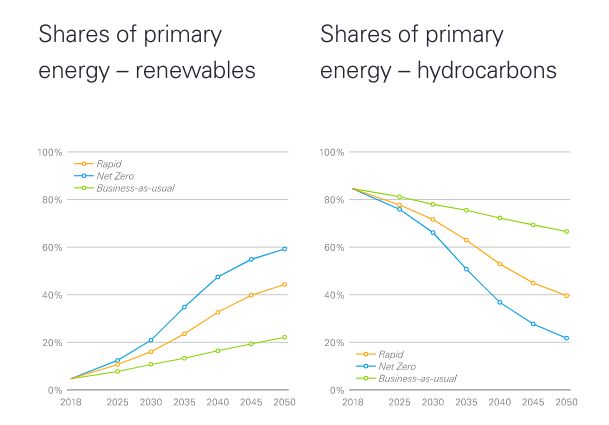

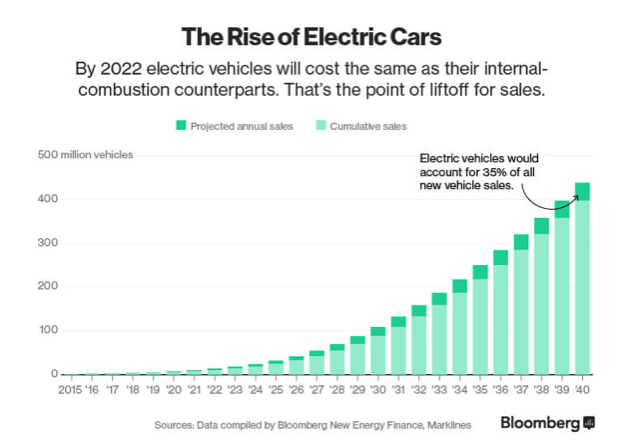

I could throw in any number of renewable projections out to make the demand case. The truth is I see them as pipedreams with current technology and economics (I wrote about renewables here).

The same goes for EVs.

My view for what it is worth is EVs can’t gain mass adoption until they are superior to internal combustion engines on all fronts.

- Price (without subsidies and incentives)

- Recharging time (less then 10mins)

- Range (without batteries requirements becoming excessive)

- Carbon intensity (little carbon saving when battery production considered)

- The power source (charging via a dirty grid achieves nothing)

I think the irony will be that we get many of the technological advancements as a result of the coming energy bull market driving oil to crazy levels. This will fuel investment into innovation away from fossil fuels.

It is what has happened historically.

“The results show that the impact of oil prices on patent applications for alternative energies is asymmetric: when prices are decreasing the reduction in innovation is more pronounced than the expansion when prices are rising. ” -Inês CarrilhoNunes

“The lithium-ion battery story started during the oil crises of the 1970s, when companies like Exxon began investing in oil alternatives and new energy sources. Whittingham, a materials scientist, was hired to develop batteries.” – Akshat Rathi

The great thing about the thesis is the fact that I only need a fraction of the projected demand growth to occur for the trade to work.

Supply Side

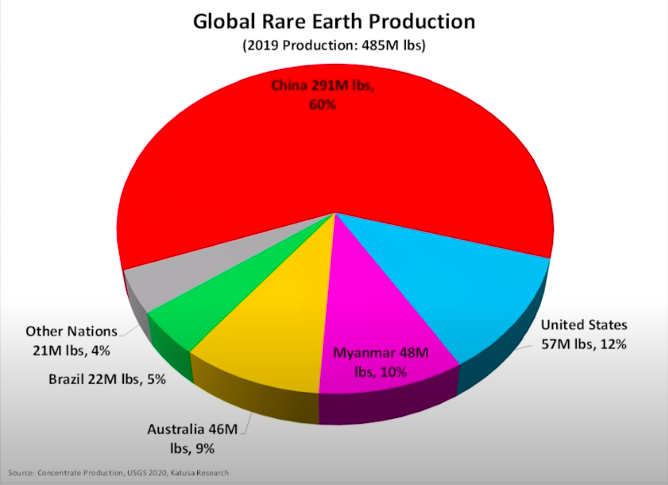

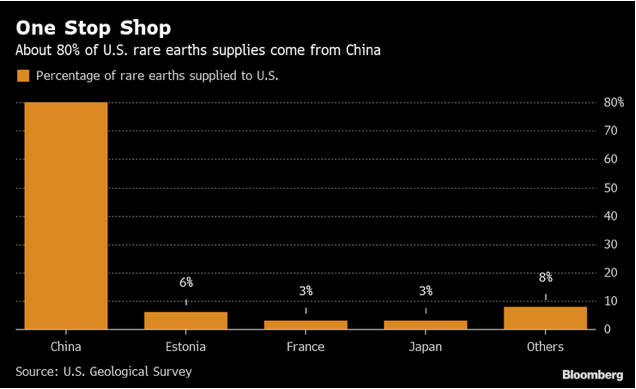

The first thing to understand with RE supply is that China controls the game.

60% is mined in China and 95%+ is processed there.

“The only active rare earths mine in the US is Mountain Pass in California. After a mothball period, it is back in production – but is now owned by MP Materials, which almost a tenth-owned by a Chinese investor.

When the US Geological Survey does its annual report on mineral production – the US is technically producing zero rare earth oxides because what is coming out of Mountain Pass is being shipped to China“

China has monopolised the REs supply chain and while the US has talked a lot about how this is unacceptable they have done very little in terms of rectifying the issue.

The supply is a similar story to uranium with an ever-increasing gap between supply and demand.

The global production is forecast to go nowhere and has been experiencing setbacks in China currently due to COVID:

“On August 20, Gao Feng, a spokesman for the Ministry of Commerce, said that from January to July this year, China exported 22,800 tons of rare earths, down 20.2% year-on-year, and the amount was US$211 million, down 26% year-on-year.“

This becomes an issue rather quickly as the below chart illustrates (even if I believe the 2040 and 2050 projections are outlandish).

Rare Earths Aren’t All that Rare

The challenge with producing REs (and the reason they were given their name) is that they’re rarely found in concentrated lumps.

“China’s sway in the rare earths market is a fairly recent state of affairs. Between the 1960s and the 1980s, the majority of the world’s supply was actually produced in America, from the Mountain Pass mine in California. The mine’s processing plant was shut down in 1998 after problems disposing of toxic wastewater, and the whole site was mothballed in 2002.

It’s only from the 1990s onward that China has shouldered the bulk of production, along with the associated environmental costs. (In 2010, the Chinese government estimated that the industry was producing 22.05 million tons of toxic waste each year.) “

How ironic is it that windfarms produce radioactive waste which is simply dumped in ponds, while Nuclear reactors are abused for their carefully managed radioactive waste!

Take the time to read this: Big Wind’s Dirty Little Secret: Toxic Lakes and Radioactive Waste

This is why few REs are mined across the world, not because they lack resources, but because of the environmental cost (federal regulations in the U.S. restrict RE mineral development).

Plus, China has set an artificially low price for REs via their disregard for the environment, as developed countries simply won’t allow radioactive waste to be dumped in ponds.

Won’t China simply keep producing and ignoring the environmental costs?

No, as Xi Jinping big effort is to dramatically reduce China’s pollution by 2035 with 120B committed and new projects axed after failing to meet winter pollution standards

“Now, local and federal officials have shut down illegal and small-scale rare earth mining operations and embarked on a cleanup of polluted sites. Part of wider efforts across China to begin addressing severe problems of water, air, and soil pollution, the cleanup here was highlighted in late May when Chinese President Xi Jinping visited Ganzhou, the major city in the rare earth mining region. Touring a rare earth processing facility that produces magnets for high-tech products, Xi discussed how to mine rare earths without causing the environmental damage now confronting Ganzhou, Longnan, and other areas in Jiangxi Province”.

China- the world’s low-cost RE metals producer is effectively dialing back its own production and raising the cost.

The big question now is: How much that process might cost?

You can bet these refining and separation plants are going to be more regulated than Olympic athletes urine in developed countries.

Our one current case study of RE production outside China is Lynas (Australian mining company). A Google search shows they are having a hell of a time with authorities in finding a suitable site to put the radioactive waste.

“Lynas is allowed to keep operating its plant and has been given six months to find a suitable site within Malaysia to permanently dispose of 580,000 tonnes of low-level radioactive waste currently stockpiled at the Kuantan facility.”

Lynas: Are we prostituting our environment and health?– Serious concerns and unanswered questions hang over Lynas operations renewal

They seem to continue to work through all the issues but Lynas’ constant struggles illustrate this is not straight forward “dig it out of the ground and ship it” mining.

Geopolitics

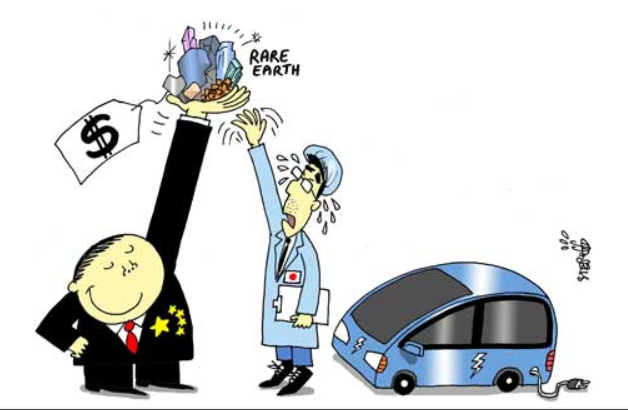

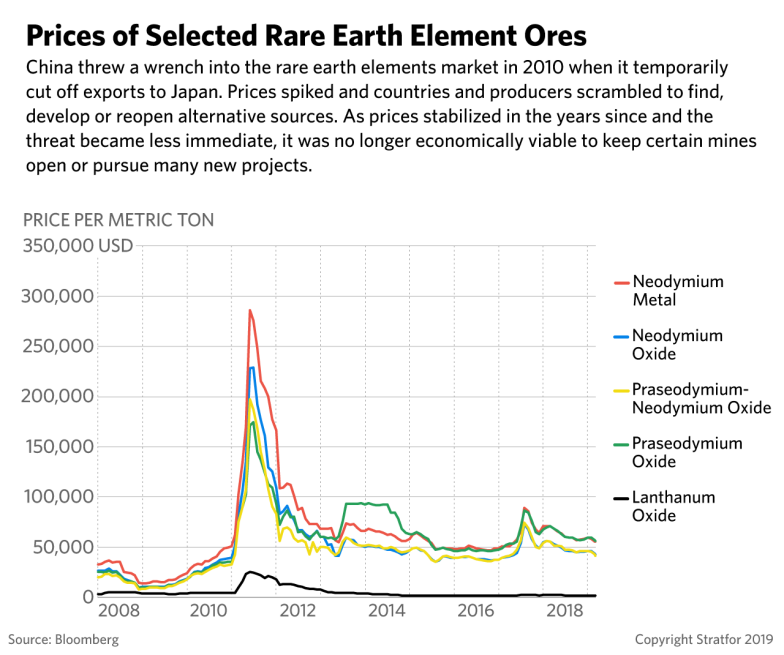

In explaining China’s monopoly over RE production and processing you probably guessed this could be a weapon for them in the ongoing trade war with the US and you’d be right.

They’ve used it as a weapon before against Japan in 2010: China Bans Rare Earth Exports to Japan Amid Tension

Which resulted in the below price reaction.

This geopolitical call option is always nice to have tucked away in the portfolio.

So how am I playing it?

I’ve held two rare earth stocks to date and plan on adding one more company.

Lynas Corp

The first being Lynas, which is really the only company actually producing meaningful amounts of REs outside of China.

They are also stockpiling REs (Australia’s Lynas stockpiles rare earths for ‘strategic’ customers), which makes them quite attractive since there are no physical holding funds.

They are also the only company outside China working through the environmental issues as mentioned earlier.

I no longer hold them because I sold out of the position in March last year on the announcement of Westfarmers making a bid for the company. The stock price jumped and I decided to spread the winnings to another REs play Greenland Minerals.

I intend to get back into Lynas at some stage, but haven’t found the capital for it yet.

Greenland Minerals

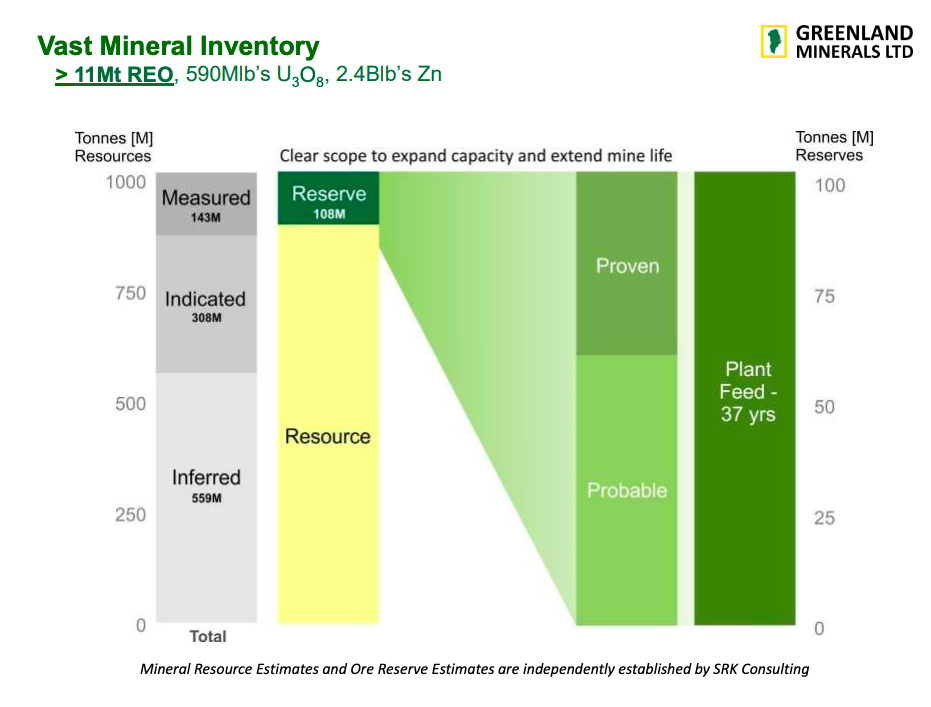

This is the bulk of my exposure to REs.

I liked this company from the outset as it is one big out of the money call option on REs and uranium.

The GGG holds 38.5m tonnes of RE oxides, relative to the total reserves of approximately 120m tonnes for the rest of the world.

The GGG’s resource contains one of the largest inventories of RE elements and uranium globally (11.1 million tonnes of rare earth oxide, 590 million pounds U3O8).

Yes, some pretty serious numbers (potentially more than twice the size of Bannermans Etango project at 271MLbs!)

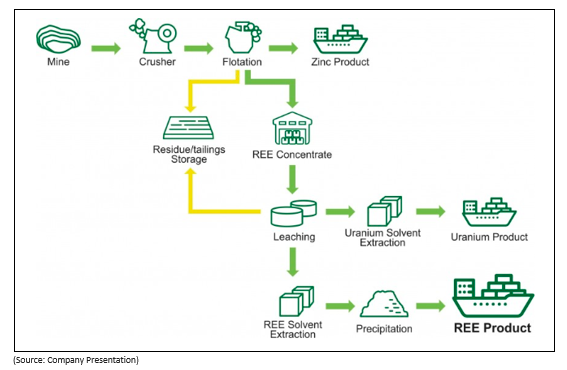

I especially like that uranium is produced as a byproduct of the RE extraction.

Now, while those numbers sound great it’s going to come at an estimated capital cost of $500m which is no small sum.

That said, Shenghe Resources Holding Co Ltd is currently the largest shareholder, with 11% of shares outstanding. While that’s great for bringing experience and support to GGG it does potentially complicate things in the event China weaponises REs geopolitically.

I see it as a high probability this gets brought out by the Chinese at some stage, but hopefully not before some healthy returns are to be had.

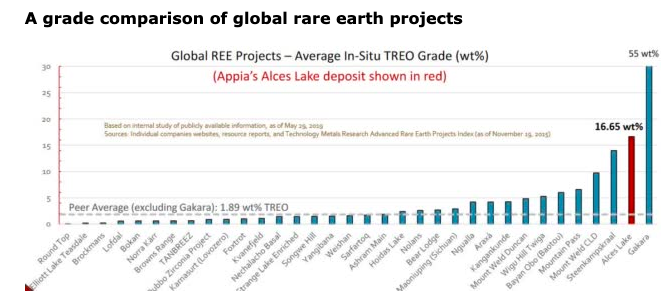

Appia Energy

This is one I’ve had my eye on for a while yet never pulled the trigger since it seemed a bit speculative for my liking.

That changed when I started to research the company and with this announcement I’m now looking for a decent pullback to build a position.

The quality of their resource is in a field of its own.

Plus at a $30m market cap, there is certainly some room to run.

Position yourself to get lucky

I’ve always been a proponent of getting as much optionality into my portfolio as possible.

It increases my chances of getting lucky since things rarely play out how we think they will.

Maximising optionality helps hedge against this.

Greenland Minerals and Appia Energy both fit this requirement since I can see them benefiting from a broad range of outcomes.

Cheers,

Ferg