In today I’m running through the usual arguments I hear for renewables.

It’s fair to say the average member of the publics knowledge is based on some variation of the below articles

Renewable Energy Is Now The Cheapest Option – Even Without Subsidies

Renewables Increasingly Beat Even Cheapest Coal Competitors on Cost

UK offshore wind ‘cheaper than new nuclear’

The most common argument usually is that wind and solar are now cheaper than coal, gas and nuclear

An LCOE (Levelized Cost of Energy) chart like this is often used to help make their point.

Or charts like this to really make their point with the huge gap between nuclear and wind/solar

This is disingenuous in the way a budget airline offers you by far the cheapest fare, but by the time you’ve gone through the checkout process and had luggage fees, seat selection fees, etc you end up more expensive than other more transparent airlines.

Hiden fees = Integration costs

Firstly, you have back up costs

Similar to having an employee who you don’t know if they will show up, you need a backup.

Battery storage is currently more frequency control and still cost-prohibitive to store more than a few hours of power.

Take the Hornsdale Power Reserve (Teslas Battery) which it claims is the largest lithium-ion battery in the world.

At a cost of $90million, what do we get?

It provides a total of 129 megawatt-hours of storage (capable of discharge at 100 megawatts).

But when you break it down this is really;

70 MW running for 10 minutes to give stability to the grid and prevent load-shedding blackouts (problems renewables created).

30 MW for 3 hours for load management to store energy when prices are low and sell it when demand is high (If this is all you really get for $90m I’d be asking for my money back).

Put another way

As take the Hornsdale Wind Farm with a generation capacity of 315MW means the battery can store 9.5% of the wind farms power for 3hours at a cost of $90m.

The kicker? The Hornsdale wind farm itself cost $89m.

*In November 2019, Neoen announced that it would increase the battery capacity by 50%. The expansion would cost A$71 million.

So $71m for an extra hour and a half of storage (at 88% of the costs of the original wind farm)

Put simply nearly double the cost of the original wind farm has been spent to provide storage for 4.5hours

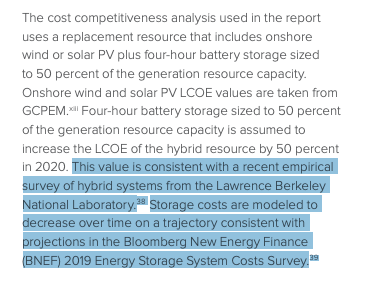

Or following reading this entire report: New Analysis Says Coal’s Hit a ‘Tipping Point’ And No Longer Makes Financial Sense in order to see what assumptions they used for storage I had to dig this out of the appendix.

Now even if I overlook the fact that you can’t replace baseload with 4hours of storage. The thing that really annoys me is these articles are based on projections and models backed up by citation rings/circle jerks where analysts see who can model the largest decrease.

Storage isn’t the only consideration either you also have:

-The cost of trying to alter existing technology around renewables such as a decline in conventional power utilisation

-Increased ramping costs. As most plants were never designed to be turned off and on rapidly.

You then have grid cost and balancing costs

This arises from the deviation between the generation of unreliable supply with power demand which includes grid and management costs.

Adding back in the hidden fees/integration cost looks like this

On top of this, you have secondary costs which are never mentioned

Efficiency loss: Is it really worth installing a flexible gas plant that will be under-utilized 80% of the time. It is effectively another subsidy to renewables.

Material cost: Short lifespans of equipment vs gas, coal, and nuclear. Recent studies have shown lifespans to only be 12-15years when the assumption was 20-25years. Which makes for a huge difference over the comparable life of gas or nuclear plant of ~60years.

“The analysis of almost 3,000 onshore wind turbines — the biggest study of its kind —warns that they will continue to generate electricity effectively for just 12 to 15 years. The wind energy industry and the Government base all their calculations on turbines enjoying a lifespan of 20 to 25 years.”

Energy cost: Higher energy cost of building renewable capacity measured in kWh of produced power.

Recycling cost: Higher recycling costs of VRE and backup capacity after its useful life

The next most common argument is the ‘learning curve’

This generally just involves drawing as many parallels to Moore’s law as possible to support their argument.

“Can sustain a higher learning rate for longer” = “Let me get carried away with my projections.”

Yes there has been a dramatic reduction in costs, but this happens with anything from toasters to TVs as they are mass-produced in large (normally Chinese) factories the costs fall. Then you hit a point of diminishing returns especially if the cost of raw materials starts to rise.

This is not what we are seeing with renewable projections they are continuing to project the recent gains to continue way out into the future.

The thing is that unlike Moores law renewables and EVs are anchored to the physical reality of materials and engineering.

To use smartphone batteries as an example my iPhone 3 battery lasted about a day and 7 years on my iPhone 10 still lasts about a day.

The push for increasing efficiency is resulting in ever-larger turbines but this is running into physical constraints.

The bearings are one such example.

“In 2011 a senior wind engineer told me bearings are the Achilles heel of wind turbines, his words were “we need a quantum leap in bearing material technology”. As of late 2018 turbine owners were still experiencing problems with wear. The bearings wear out too fast, but if they make the bearings bigger and stronger, turbine performance plummets, because larger bearing create greater friction.”

“The problem is the bearings. If we make the bearings bigger, the bearings last longer, but making the bearings larger increases friction, which kills turbine efficiency. But we can’t keep using the current bearings – replacing them is sending us broke. What we need is a quantum leap in bearing technology – bearing materials which are at least ten times tougher than current materials.”

Ultimately the learning curve needs to simply deliver on the basic assumption that wind turbines can operate effectively for 25years.

Not the 12-15 year lifespan the studies have found or that a wind turbine will typically generate more than twice as much electricity in its first year than when it is 15 years old.

The claim that “Intermittency is manageable via smart systems”

I don’t buy this at all as demand is relatively fixed i.e. there is always going to be a spike in demand at certain times such as when everyone gets home from work in the evening and cooks, turns on lights, heats etc.

The only way this can be balanced is via battery storage which brings us back to the earlier issues of cost.

People may point to Denmark, Germany as examples of the system working fine, but if you dig into the details it is because they could import electricity when necessary.

Denmark imports roughly 40% of its power on average from Norway, Netherlands, and Swedens Hydro, gas, and Nuclear.

Yet the media loves to put out articles like the below as if it’s a great achievement

Portugal generated enough renewable energy to power the whole country in March

Dig into the article it was for too short periods: “The grid only ran on 100% renewables for relatively short periods: two 70 hour spans (Portugal managed a four-day streak in 2016)”

Germany is in the same boat having gone from a net exporter of power to a net importer as a result of its renewable build-out.

Yet there is no mention in the media of in December Germany would have experienced blackouts if not for its ability to import electricity from France and its nuclear fleet.

What’s interesting is the Eurozone’s continued to push for renewables, as if more countries switch to net importers rather then exporters of power will there eventually be a point at which blackouts will start to occur infrequently.

It helps explain why Japan is building 22 new coal plants. They have no ability to import power from surrounding countries so renewables weren’t a choice as they need baseload.

Lastly, wind and solar simply doesn’t make sense in most of the world

As much as BloombergNEF analyst’s projections refuse to acknowledge it there are large swaths of the world that experience little wind and solar.

Wind power generation (note the lack of wind through India and Asia)

Red = High Wind Green and Blue = Low Wind

Then for solar the same problem again most of Europe and Southern Asia just aren’t that well suited to solar production.

The areas that are well suited to both are Africa (which isn’t really in any state to take advantage of this) and Australia is trying to take advantage of this and running into all the other issues I’ve outlined.

Why if renewables are so cheap why do they make electricity so expensive for the consumer?

Charts from 2019 and 2016. Its currently a game of musical chairs between Germany, Denmark and South Australia (when its shown by itself) for the most expensive electricity.

And thus ends my renewables rant

The problem with pointing all this stuff out is I’m not sure it will matter for quite a while yet as the Fed and Eurozone head down the road of MMT funds will almost certainly be poured in renewable projects regardless of their effectiveness.

Take Germany who has spent $580B on renewables over the last decade had no emission reductions while increasing their cost of electricity by 50%.

France’s electricity on the other hand is half as expensive and half as carbon-intensive via nuclear.

Takeaway

The main reason I went down the renewable rabbit hole is to try and punch holes in my oil, nat gas, and uranium theses. As if projections like Bloomberg’s New Energy Outlook are even half right the impact will be substantial.

As you’ve probably guessed I’m not the least bit concerned.

The uranium bull thesis works currently even if none of the planned or proposed reactors are ever built. The needs of the current fleet and size of supply deficit mean we will get a price reaction before the end of next year due to utility needing to start contracting.

As for the oil/gas market, I actually think renewables are helping set the stage for a huge energy bull market. The reason being the longer renewable projections are deemed credible the less will be spent by fossil fuel on CAPEX which results in less supply and a higher incentive price required to correct the imbalance (The Next Big Trade is coming).

Cheers,

Ferg