The monkey trap involves making a hole in a coconut large enough to fit the monkey’s hand through, but not large enough to pull it back out with a handful of nuts.

The trap relies on greed because the monkey refuses to let go of the nuts to free himself which results in him being captured or killed.

As you probably could have guessed, I’m using this as an analogy for getting killed in a bull market as a result of being greedy and unwilling to leave any gains on the table.

A plan for hopping off this train (once things start to get a bit crazy)

The first strategy I plan to use is scaling out slowly. There will be no binary decision where I plan to sell everything at once.

These cyclical sectors are inevitably going to overshoot the mark, so selling out slowly is the best way to ease the pain that hindsight bias will bring i.e. selling at 5x and watching it go to 10x.

To have a good outcome in a market that goes parabolic we need to accept we will get out early and be ok with it.

This means leaving money on the table- maybe even a lot of it… which is fine.

Otherwise, you risk one of two alternatives:

- Trying to catch the top, which dooms you to ride it down the other side.

Similar to thinking you can watch the entire show and still leave before everyone, it’s not going to happen.

- Or risking Druckenmiller’s fate in the Tech Boom of getting out early and then jumping back in at the top.

“I didn’t learn anything. I already knew that I wasn’t supposed to do that. I was just an emotional basket case and couldn’t help myself. So, maybe I learned not to do it again. But I already knew that.” – Stanley Druckenmiller

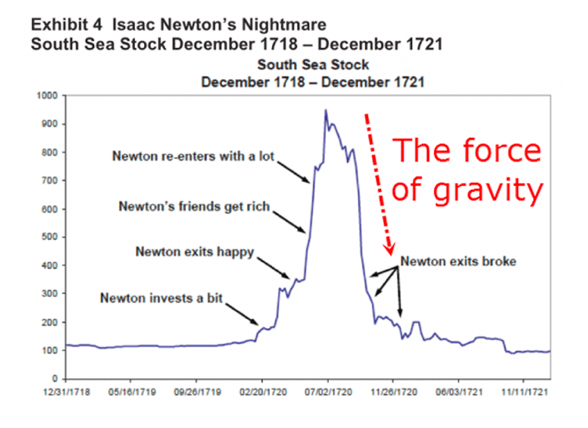

Or take the other famous example of Issac Newton losing his shirt

“I can calculate the motion of heavenly bodies, but not the madness of people‘

If you think you can remain objective in a crazy bull market, get out early, and sit on the sidelines, just remember these two examples.

Technical considerations for exiting?

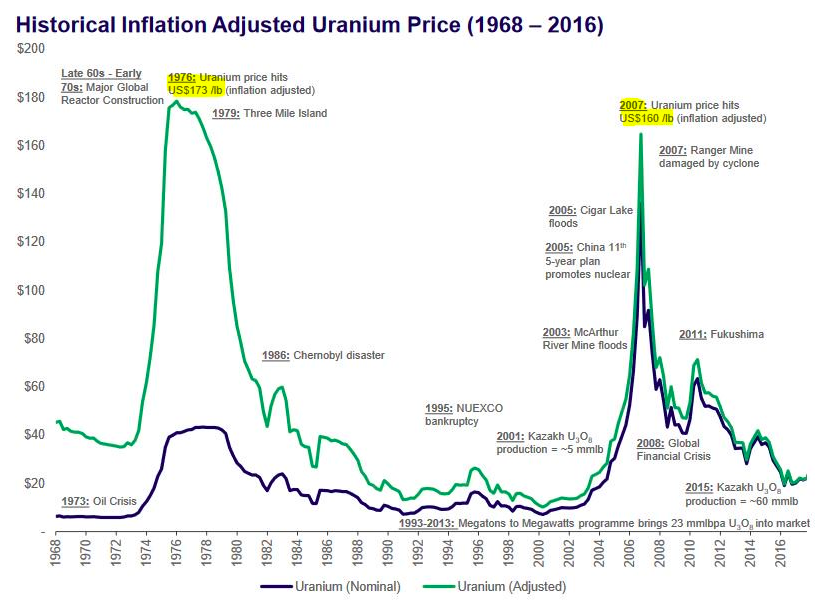

For this, I’m going to use the uranium sector and Andrew Weekly’s guide to illustrate. Andrew has put together this slide deck which has a number of primary and secondary considerations for when to start exiting the trade which I think is smart.

Primary exit considerations

1. Two to three consecutive years of term contract volume in excess of 170mlbs annually.

2. Spot price exceeds the term price by $20/lb or more during the excess of the ~$50/lb incentive price.

3. Spot price exceeds $90/lb.

4. Market listings reach ~150 aspiring hopefuls.

5. Spot & SWU price high-level convergence or spot exceeds.

Secondary exit considerations

1. Annual production + near term (2-3 yrs) in-construction buildout is confirmed to match current consumption at incentive price or higher.

2. Nuclear reactor accident at any time during the cycle.

3. Broad stock market crash during mid-late $50+/lb uptrend.

While I like these exit considerations, I wouldn’t let them make up more than 50% of my scaling out.

The reason being is that I believe it’s highly likely this rally overshoots all reasonable assumptions.

As I see this being Soro’s theory of reflectivity on steroids with the addition of:

- Social media

- Smartphones

- Everyone connected 24/7

- Notifications and commission-free trading

- Stimulus cheques in the hands of Robinhood traders

Behavioral considerations for exiting?

This is where it becomes more art than science.

Examples might be;

– A friend you mentioned the sector to a while ago reaching out and asking how to invest in it = sell 10%

– Hear it being discussed at a BBQ or party = sell 10%

– Taxi driver/ plumber mentions it = sell 10%

– See it mentioned on news/magazine cover = sell 10%

– Have dozens/hundreds of @uraniumtothemoon types joining twitter and trolling anyone recommending caution = sell 10%

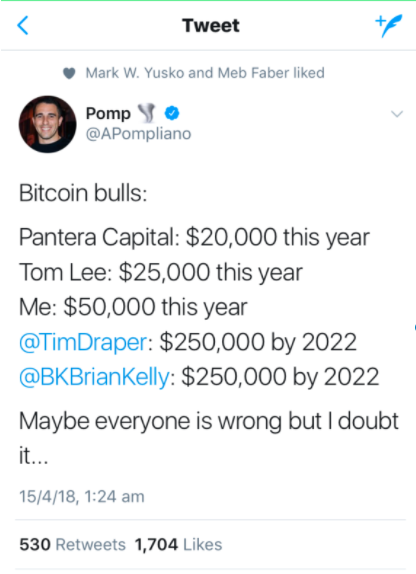

As a thought experiment, just think back to the crypto boom and how many of the above examples occurred to you personally?

I remember clearly heading to a New Years’ festival with a good friend and a number of his friends.

And when my friend introduced me as, ”someone who trades for a living” the group’s eyes lit up. Two of them stated they planned to do the same with crypto and everyone nodded their heads in approval.

But, when I was asked for my opinion and shared my thoughts (quite hesitantly, it was NYE and I did not want to talk about crypto)- mainly how I thought that crypto was a bubble and wouldn’t end well… the room’s mood changed.

The reception to this statement was the same I imagine as kicking the family’s dog off the balcony.

There was silence then someone said; “What sort of trader was I, missing returns like this“, and finally they all concluded I was just sour I’d missed it.

We left it at that and after a few beers, the guys seem to have forgotten everything about their trading aspirations and my ”lack of vision for the future”.

That was the 30th of December 2017.

I figured even if I was in bitcoin I would have been out before $10,000 applying the above rules.

I like to do this whole exercise ahead of time as I do think it will be far harder to rationalize exits when the euphoria has taken hold.

Just remember…

People quickly forget how crazy things get. And I am aware I might (which is why I’m mainly writing this post as a reminder to myself).

Just take these projections below. They all seemed possible at the time and only with hindsight bias do we write them off as crazy.

History will repeat itself in the Uranium market as everyone becomes an overnight expert about the supply deficit and drives prices to crazy levels in what is a tiny and illiquid market.

It will be essential to go in with a plan, otherwise, the odds are we’ll become a victim of our own ”monkey trap”.

So, my advice is: Mentally prepare to leave some nuts on the table.

Cheers,

Ferg